WELREX® CIO Chris Brils explains the WELREX investment strategy in light of recent developments.

Now that the Federal Reserve has paused interest rate hikes, it might be an opportune moment to get involved again in credit investments. We currently find the spread on global high-yield bonds at just over 450 basis points in option-adjusted spread (OAS) according to Bank of America. We look at the OAS as many high-yield bonds are called or tendered before maturity and this shortens the actual duration. At the end of the first quarter, this still stood at just over 300 basis points.

In comparison, the global high-yield bond default rate has risen slightly – from around 3% at the end of the first quarter towards the 4% mark (Moody’s). This is comprised of a relatively low 2% in the United States and a much higher 6.5% in Europe. Moody’s expects this number to rise further by another couple of percentage points in the year ahead.

Recent spread record

Last summer global spreads were hovering around the 600 basis points mark. Since then, we’ve seen a relatively strong back-up rally, followed by the most recent widening. We agree with Moody’s that defaults will probably rise, but only moderately. Many issuers have been smart in the recently booming primary market for new issues and have refinanced themselves where possible. This means that most issuers are now not looking at a wall of maturities that might be difficult to refinance in any upcoming US recession or global slowdown. Refinancing is often one of the main reasons for credit defaults occurring.

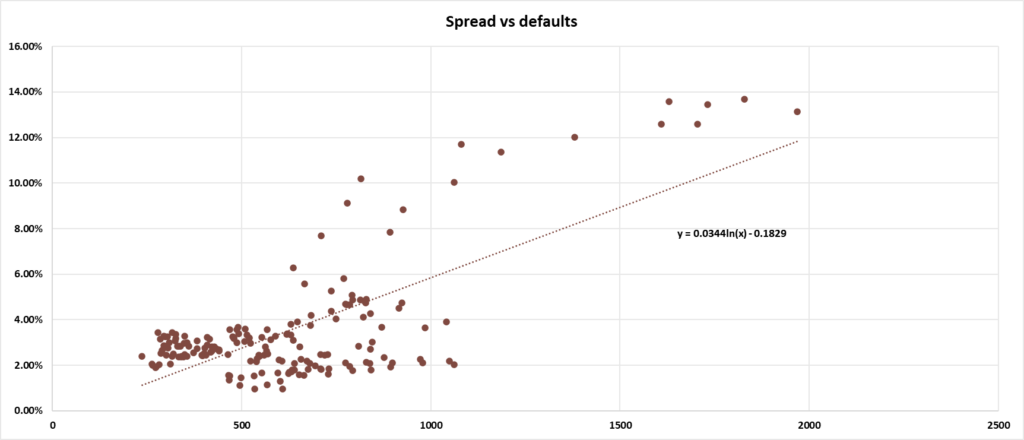

At WELREX we run a spread-based relative value model that helps us to assess relative value in yield spreads, taking into consideration default rates. Defaults are still relatively low, and the default cycle has yet to get started. In our outlook, we are assuming a US and global growth slowdown and a deterioration of credit metrics including a moderate increase of defaults to around 4% globally.

Source: Talgar Consulting, Bank of America, Moody’s. Data as of the end of 2005 to mid-2023.

Model outcome

In our model, we plot spreads vs. defaults, after removing any lag – meaning that spreads are the lagged variable vs. defaults – as we typically see spreads widen before any peak in defaults. The idea behind this is to provide couplings of data points where the spread is reflective of a resulting default level over time.

The model indicates that the current 3% default level corresponds well with a spread level of around 500. However, we do expect global defaults to rise towards at least 4% which seems to indicate a spread level of around the 600 mark, which we are now closing in on. Therefore, at current default levels, the high-yield bond market appears to be fairly valued, although we would prefer to see a higher level of defaults priced in.

The model also indicates along the curve that this forecasted default level corresponds with a spread level of around 600 basis points. Indeed, in Q1 of 2022, we did see a spread level of around 600 in the global high-yield market which seemed to be fair for the expected credit deterioration ahead. However, since summer last year and well into January of this year, we witnessed a strong rally in spreads, which we’d argue is not underpinned by an expectation that credit quality will improve and is not illustrative of the inflationary and recessionary environment we are currently in. This may explain why there was record issuance in credit markets at the start of this year, especially in European high yield. Issuers are wisely using this spread-narrowing window to refinance debt and extend maturities hopefully beyond the tenure of the recession ahead. In mitigation, in this downturn, most issuers have not taken on excessive debt on their balance sheets, but the question remains how much debt is feasible going forward at higher refinancing rates? Therefore, a moderate increase in defaults to around the 4% level is reasonable.

Conclusion

In summary, we still cautiously see some value in high-yield bonds, but in our base-case scenario, with defaults rising towards 4% in an unsupportive economic environment, we think global high-yield spreads can rise again towards 600 basis points where the asset class is a strong buy. We regard the spread rally since last summer as not driven by fundamentals, but rather a ‘fool’s rally’ driven by investor appetite and new issue market.

This does not mean there is no value at all in corporate bonds: total returns are cushioned to a large extent by the relatively large coupon clip, which typically makes up over 80% of the total returns achieved.

Also, currently, the spread compression between high-yield and investment grade is still near record-tight levels, meaning that it is probably best to focus on the crossover segment between investment grade and high-yield with a particular emphasis on investment grade in the triple-B tier – issuers that seem to be safe in their investment grade status (contrary to the ‘fallen angels’) but still offer a decent yield. And this, combined with a careful selection of issuers in the double-B tier, the highest quality within high-yield – issuers that we assess to have a good chance to potentially gain investment grade status (‘rising stars’) in the coming years. This still leaves room to rotate any portfolio further and more fully into high-yield bonds as spreads widen further.

Chris Brils

Chief Investment Officer

WELREX

Related

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]

Future of thematics is multi-asset

When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths. Instead, we argued that the […]