WELREX® Director John Longo shares his view on the latest meeting of the Federal Reserve.

Chair Jay Powell and his colleagues at the Federal Reserve delivered a hawkish message in the meeting minutes and press conference following the June 14th Federal Open Market Committee Meeting. The Fed’s dot plot projected two further rate hikes of 25 basis points this year, despite the June pause, and suggested that a sizeable rate cut is not in the cards for at least a year. Yet the S&P 500 rose almost 2.0% from Wednesday afternoon through Friday. Tech stocks, as represented by the Nasdaq Index, increased a similar amount despite their historical adverse reaction to a rise in interest rates. What is going on? In brief, inflation is trending in the right direction, any U.S. recession is likely to be somewhat short-lived, and there is genuine investor excitement about artificial intelligence (AI).

Inflation is trending in the right direction

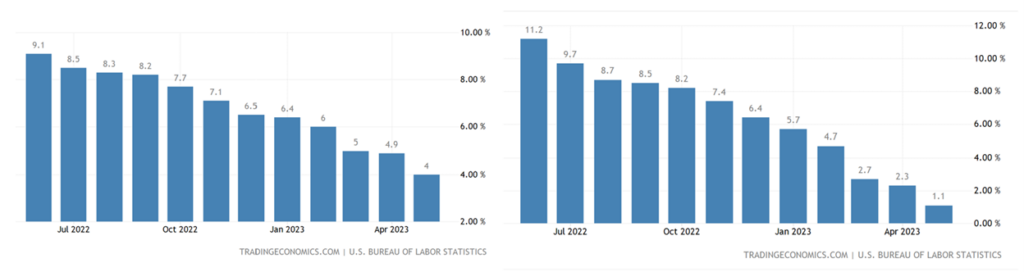

Although the Consumer Price Index (CPI) is still double the Fed’s target of 2%, it is clearly trending in the right direction. Furthermore, the Producer Price Index (PPI), a measure of wholesale inflation that contains a larger weight in commodities, is dropping at an even faster rate. (See graphs below). As we have discussed previously, the base effect and improvements in supply chain bottlenecks make it likely that the trend of decelerating inflation will continue. One caveat, there is the threat of a strike at United Parcel Service (UPS) beginning on August 1st, which has the risk of temporarily disrupting trade which accounts for roughly 6% of U.S. GDP. If a strike is authorized and persists the federal government will almost certainly aim to mediate and help resolve the dispute.

Source: TradingEconomics.com

Most U.S. recessions last less than a year with modest drops in GDP

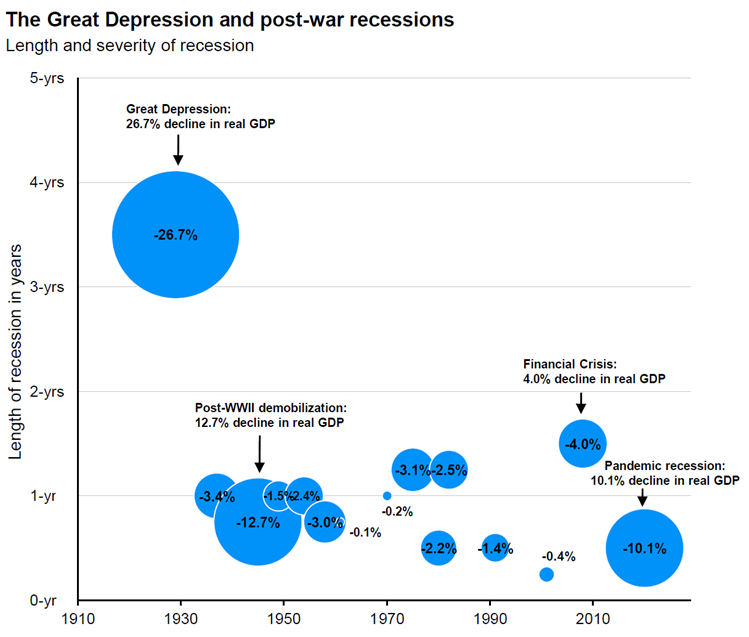

Of course, no recession has yet been declared by the National Bureau of Economic Research (NBER), and the possibility of a soft landing still exists. The recent stock market rally, which some analysts are hailing as the start of a new bull market, may be a sign of investor euphoria or the dawning realization that there will be no recession. A third possibility exists. Namely, there may be an impending recession, but it is likely to be shallow and short in duration. The chart below shows recessions in the U.S. since the early 1900s.

Source: JP Morgan

Note the recessions from the 1960s through the early 2000s on average lasted less than a year and the drop in GDP averaged a bit less than -2%.

The telltale signs of a recession (inverted yield curve, drop in Leading Economic Index (LEI) for 13 consecutive months, weak Institute for Supply Chain Management (ISM) numbers, etc.) are still here but the market tends to rally when it sees brighter skies ahead. On average, the market has bottomed about 5 months before the end of a recession, but there is a precedent for it bottoming as early as 10 months before the end of a recession. Hence, the market may be rallying because it is anticipating a short and shallow recession.

The A.I. boom is real, although valuations are on the pricey side for select stocks

The boom in AI, spurred by the phenomenal growth of ChatGPT, is real and may be the biggest innovation since the mass adoption of the internet. It is important to separate the dramatic increase in a small number of AI-related stocks – such as NVIDIA, C3.ai, AMD, Microsoft, Palantir, and Alphabet – from the potential of AI to positively impact most operating businesses. In brief, AI will improve the productivity of nearly all businesses, while destroying others. Investment legend, Stan Druckenmiller, cited an extreme example of ChatGPT making top programmers 7x-8x more productive in as little as 5 months because AI can write computer code upon command. Most industries will experience a tiny fraction of this productivity boost (e.g., elimination of some customer service reps), but the net benefit of AI should be a secular positive for stocks. McKinsey published a white paper citing trillions of dollars in expected benefits that may accrue to the global economy in the decade ahead due to AI productivity improvements. Even“permabear” Nouriel Roubini sang the praises of AI and its benefits to the global economy. In short, we think the benefits of AI are real and here to stay, despite the froth that may affect select stocks. The huge amounts of cash on the sidelines may buttress the case for an eventual sustainable new bull market once there is further clarity on the recession versus soft landing scenarios.

John M. Longo, Ph.D., CFA

Director, WELREX®

Related

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]

Future of thematics is multi-asset

When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths. Instead, we argued that the […]