Cap Gemini recently published an important and comprehensive “state of the industry” report – World Wealth Report 2024. Like many in the industry, the WELREX team absorbed this with great interest.

Everyone will extract from the report what interests them and, like us, they may add their perspectives to Cap Gemini’s insights. From our viewpoint, three things resonated most relative to our experience of Wealth Management in general and the WELREX proposition in particular.

- HNWI wealth and population recovered in 2023 from 2022 lows – but is the industry focusing on the right audience segment?

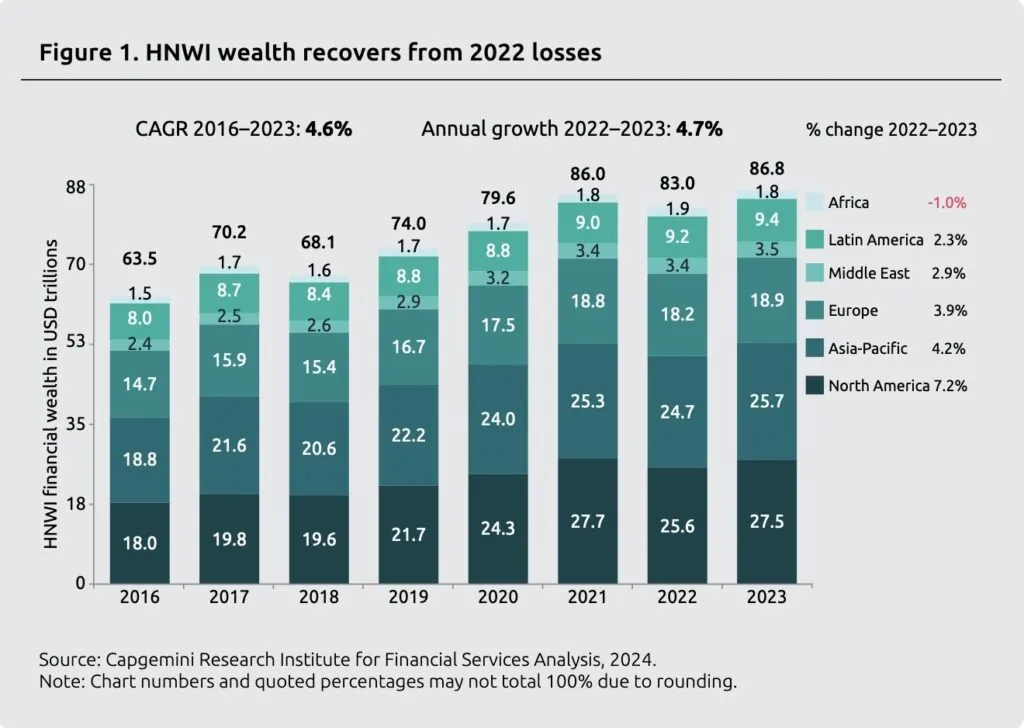

It’s pleasing to see that in 2023 Global HNWI wealth and population took upward trajectories – +4.7% and +5.1% respectively – after drops in 2022. Solid economic resilience, cooling inflationary pressures, and recovering 2023 global markets drove growth as HNWI wealth and population even surpassed the highs of 2021.

We were gratified to see growth in Emerging Markets: our focus at WELREX is to support HNWIs and their Relationship Managers in territories such as the Middle East, the former Soviet Union, and parts of Asia, so we stand ready to help and benefit from the 2024 horizon forecasts.

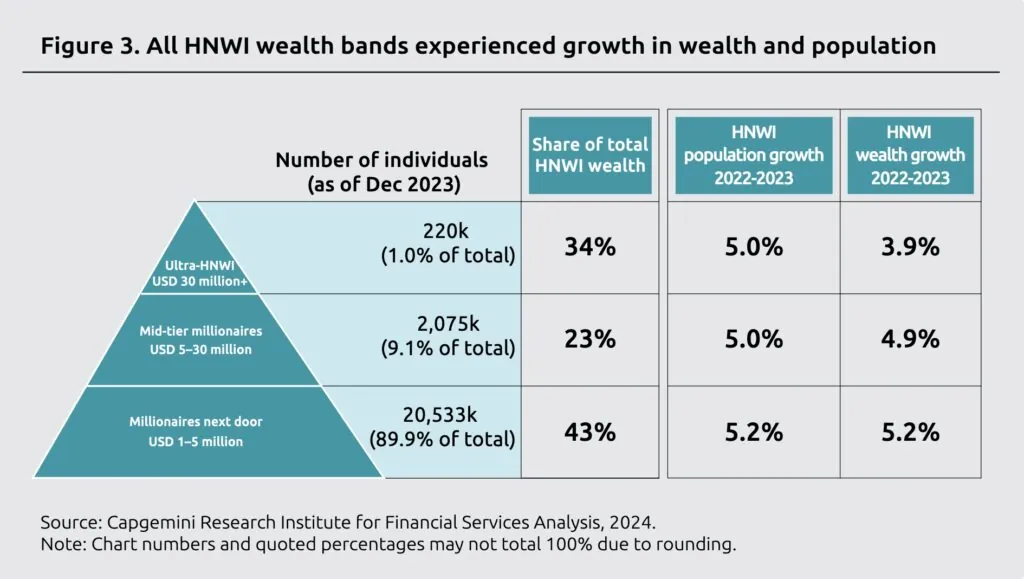

The report emphasised the importance of UHNWIs (defined as those with >$30m in assets). According to Cap Gemini, that small group (1% of the population) accounts for 34% of overall global wealth. It’s logical that the bigger industry players – with larger fixed cost bases to cover – will continue to push the minimum client assets bar ever higher whilst not necessarily being able to focus on improving client experience. Digitally native players – like WELREX – don’t have these limitations. We’re intently focused on HNWIs with between $1-30m investable assets, who represent the balance of the wealth population.

Cap Gemini data tells us that this group represents more than 22,500 individuals globally. We know they are active, high-growth, demanding clients who deserve the best offering and client experience to meet their growing needs and represent a significant opportunity. This group is our absolute focus at WELREX: as our current clients know, we have the right set-up, tools, and skills to give them what they demand and deserve. Why would you disadvantage a client with $5 million investable assets today purely because your senior management has set a bar of $20 million at the outset (or near-term potential)?

- Behavioural Finance and AI are key to understanding and delivering on client needs

Cap Gemini acknowledges that usage of Behavioural Finance remains low across the industry. This surprised us since a focus on Behavioural Finance has been key to the WELREX platform from the outset.

That said, with 75% of senior WM execs now stating that “AI will significantly impact the industry within the next two years”, the time is ripe for better tools to be used more pervasively. Firms are looking to leverage AI in pursuit of performance improvement across many aspects of their client service delivery.

“By integrating behavioral finance with artificial intelligence, WM firms can better recognize and address HNWI client needs; and Gen AI can aid hyper-personalization of relationship manager/client experiences and communications.”

Source: Cap Gemini World Wealth Report 2024

At WELREX we use Behavioural Finance as an embedded part of our client onboarding process, with relevant AI tools deployed to assist investment analytics. This ensures that we intimately understand from the outset what our clients truly need and their behavioural biases – so that our investment solutions can be hyper-personalised, irrespective of client portfolio size.

An example: one of our clients understands the fast-moving goods and services sector, having built a successful business in the industry. She has a high-risk tolerance and tends to add to the portfolio despite 30-50 % swings either way in its value. Our AI-assisted analytical tools can generate specific threads that include macro and micro analysis of the industry and its investable players. The latter enables our investment team to select suitable investment positions and keep sufficient cash in this client’s portfolio to capitalize on the investment opportunities from the watchlist (compiled and tracked by the investment team assisted with AI tools) to match that client’s convictions and behavioural investment style.

- As Cap Gemini says, “Wealth Management firms are data-rich but CX-poor”

The report calls out strongly that the huge amount of customer and behavioral data flooding the industry is not resulting in improved customer service. It’s clear that investors are more sophisticated, more digitally savvy, and they evidence significantly increased demand for personal service. Firms need to get with the beat!

At WELREX we are at the forefront of the personalisation movement. We know nobody likes to be treated as a generic part of some typologised group. This is particularly relevant to HNWI population. The backbone of personalisation here is to have ‘effective lenses’ through which the relationship manager zooms in, to focus on the client information most relevant. The algorithms alone are not the best tools to decide on relevance. Technology is good at collecting, tracking, and keeping data safe, but standardized decision-making trees behind the technology don’t do any favors to personalization. A dedicated client experience team is needed to champion empathy and this is not possible without deep personal interaction. It is the Relationship Manager’s key task to coordinate with their client experience and technology teams to achieve the best customization for each client – be that around predictive analytics, frequency of interaction, and the style of client communications.

We’ve long held the view that the highest quality Customer Experience remains a challenge for WM firms – see our article “Customer Experience: the next differentiator in Wealth Management”. That’s why we embed Behavioural Finance, supported by AI, as a fundamental part of our client journey. And we are committed to delivering hyper-personalisation across all our solutions.

When it comes to investment decisions, we believe insights are the most valuable part of the client experience, and making sense of those insights is much more valuable than flooding a client with data. After all, a client may not have the academic or practical background to place the data in a ‘meaningful order ’in their mind, let alone the restriction they may have on their time.

Related

Investment Outlook 2026

Maintain conservative positioning with half portfolio in Gold and Swiss or CHF-hedged assets; equal allocation between bonds/equities. By Kirill Pyshkin Chief Investment Officer of WELREX See this article published on Wealth Briefing We maintain a conservative investment outlook for 2026, characterised by the following positioning: But before we detail our 2026 investment outlook below, we […]

Quantum technologies: the next digital revolution

Kirill Pyshkin Investors fear the quantum concept as an unknown quantity, but once they analyse case studies around its transformative nature, it is likely to rival the potential of AI © Envato This article was published in PWM, and FT-affiliate publication, on 14 Nov. 2025 The year 2025 marks a century since quantum mechanics reshaped […]

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]