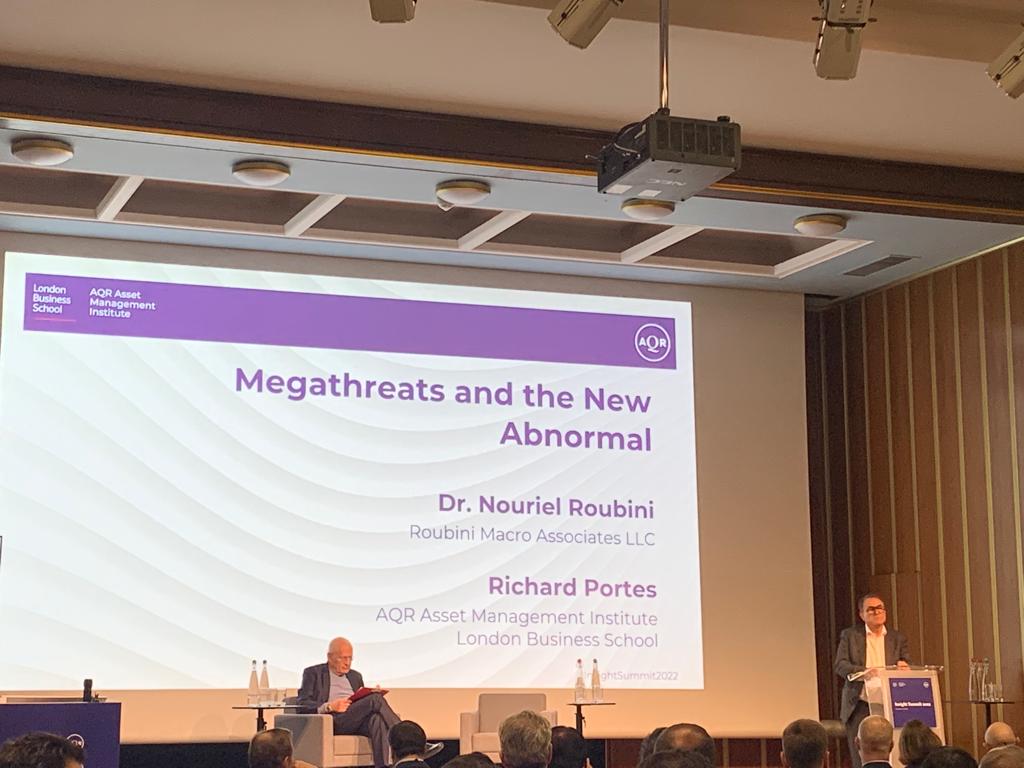

Key WELREX® insights from the recent AQR Institute Insight Summit

Senior members of the WELREX team attended the recent AQR Asset Management Institute Annual Insight Summit at London Business School.

The team enjoyed the wide-ranging conference content, which included extensive discussion of all things Crypto and a deep dive into the contextual macro factors which will influence the Asset Management industry and global economies in the coming months and years.

Speakers included:

- Christine A. Parlour, Chair of Finance and Accounting, UC Berkeley Haas

- Paolo Ardoino, CTO of Tether

- Fabio Panetta, Member of the Executive Board, European Central Bank

- Patrick Honohan, Honorary Professor, Trinity College Dublin, and CEPR

- Jordan Brooks, Principal, AQR Capital Management

- Dr. Nouriel Roubini, CEO, Roubini Macro Associates LLC

- Richard Portes, Professor of Economics, London Business School / Academic Director, AQR Asset Management Institute

Following a productive networking session and over a casual team dinner, each of the team shared their key observations from the event in relation to the WELREX vision and mission.

Challenging times

Yevgeni Agerd, Founder & CEO kicked off by reflecting on the ten “Megathreats” articulated by Nouriel Roubini:

“Roubini paints a dark picture – warnings about the debt crisis and bailout trap, stagflation and currency meltdown, AI job destruction, new cold war, and climate catastrophe, amongst others. Some key points stood out for me:

- In the West, the debt/GDP ratio is higher than it was when we came out of WWII and Great Depression

- The concept of “geopolitical depression” – outright deglobalisation or at least “slowbalisation”, and offshoring being replaced by “friendshoring” – will have knock-on effects on capital flows

- The “weaponisation” of the USD and the potential for Geopolitical division between the US and China has the potential to drive their respective allies to favour either USD or RMB as their predominant currency – not both.

Whether they all materialise or not, these headwinds – geopolitical and economic, global and domestic – will have impacts on our sector which we need to be aware of and embed in our operating models.”

Chief Operating Officer Glenn Berry picked up on the economic theme from the comments of Roubini, Honohan, and others:

“Today we heard a lot of doom and gloom which, at face value, suggests no signs of any positives in any timeframe like our lifetime! Relating it back to Wealth Management, it could mean people will either want to make money in the short term or give up altogether. A more considered view would see bumpy outcomes for the foreseeable future with some relatively safe havens. I would imagine WELREX clients will be looking for that more considered view and advice on where the ‘safe havens’ are.

In this context and in the face of a tough economic outlook, with returns difficult, high-quality Relationship Management becomes more important than ever”

Crypto – threat or opportunity?

In the conference, ECB Executive Board Member Fabio Panetta railed against unbacked Crypto and emphasised the need for central bank-governed alternatives.

WELREX Investment Director Stephen Ashworth acknowledged that the event tried hard to present a balance of views on Crypto – an academic commenting neutrally, participants presenting the investment and economic positives, and the regulator warning that, if unregulated, crypto had the potential to wreak significant damage – but he was especially animated by the ECB’s view on Crypto:

“It’s clear to me that the chasm of knowledge between those in the crypto industry and the central banks remains as wide as ever. For all the ECB’s words implying an understanding of the potential of blockchain, it clearly needs to do more to understand the true way in which crypto tokens /digital assets can change the financial system – or maybe they do understand and are just scared by it. I feel the jury is also still firmly out on whether to regulate and legitimise crypto or not regulate and hope it goes away”.

Digital transformation continues apace but needs to keep the customer in mind

Step changes in digital functionality continue to pervade finance as many other sectors. Speakers across several sessions underlined the critical importance of transparency, clarity, and ease of use to ensure industry and end-customer adoption and confidence.

Chief Digital Officer Lorenzo Caffarri underscored the opportunity to capitalise on developments – especially digital – in customer management practices and customer experience (CX):

“The winners will be those who invest smartly in the digital tools and solutions which best meet their clients’ needs. RMs need to be able to provide data to their clients the way those clients want; clients need to be able to self-service if they want to. So, it’s critical for the best wealth management platforms to have the embedded flexibility to “toggle” as needed to meet the client’s need”.

Building on this, Chief Marketing Officer Joe Clift stressed the importance of remaining tuned into the “voice of the customer” in good times and bad:

“From a brand and marketing point of view, there’s strong documented evidence from previous recessions and economic crises, that brands and businesses who have stayed closest to, listened hardest to, and responded best to the needs of their customers or clients, have emerged the strongest. I see no reason to believe differently this time”

In conclusion, Yevgeni struck a pragmatic and positive note:

“In the short to medium term, it’s clear we face a “new abnormal” – continual disruption in geopolitics, finance, and economics. Disruption demands agility – in business models, operating models as well as strategies and tactics.

The good news is that we built WELREX to be inherently agile – so we can adjust focus, as needed, to private markets (PE/VC/Real estate development finance) and alternative instruments (hedge funds, algo trading, absolute return). Our initial customers clearly welcome this flexibility as part of our DNA.”

Related

Investment Outlook 2026

Maintain conservative positioning with half portfolio in Gold and Swiss or CHF-hedged assets; equal allocation between bonds/equities. By Kirill Pyshkin Chief Investment Officer of WELREX We maintain a conservative investment outlook for 2026, characterised by the following positioning: But before we detail our 2026 investment outlook below, we would like to review the final performance […]

Quantum technologies: the next digital revolution

Kirill Pyshkin Investors fear the quantum concept as an unknown quantity, but once they analyse case studies around its transformative nature, it is likely to rival the potential of AI © Envato This article was published in PWM, and FT-affiliate publication, on 14 Nov. 2025 The year 2025 marks a century since quantum mechanics reshaped […]

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]