WELREX® Director John Longo shares his latest views on US markets and the economic outlook

Jay Powell surprised global financial markets at his press conference following Wednesday’s Federal Open Market Committee Meeting. He poured cold water on the notion that the Fed is almost done with its rate hike campaign, saying, “It is very premature to be thinking about pausing… We have a way to go.” By “way to go”, he means that he will keep raising interest rates and shrinking the Fed’s Balance Sheet in his quest to get inflation under control, even with the uptick in the U.S. unemployment rate to 3.7%.

The S&P 500 promptly went from being up 1% to down 2.5% on the day. Prior to the Fed’s press conference, the consensus was that the Fed would raise rates by 50bps in December and then pause to assess the cumulative effect of its rate hike cycle. The data clearly show that some parts of the economy are slowing due to the YTD rate hikes. For example, Carvana plunged 39% on Friday after Morgan Stanley said the car retailer may be worth only $1 a share as the used car market has started to crack amid the surge in financing costs. The housing market is also poised to end its rapid ascent as inventory accumulates amid mortgage rates that have hit 7% for the first time in 20 years.

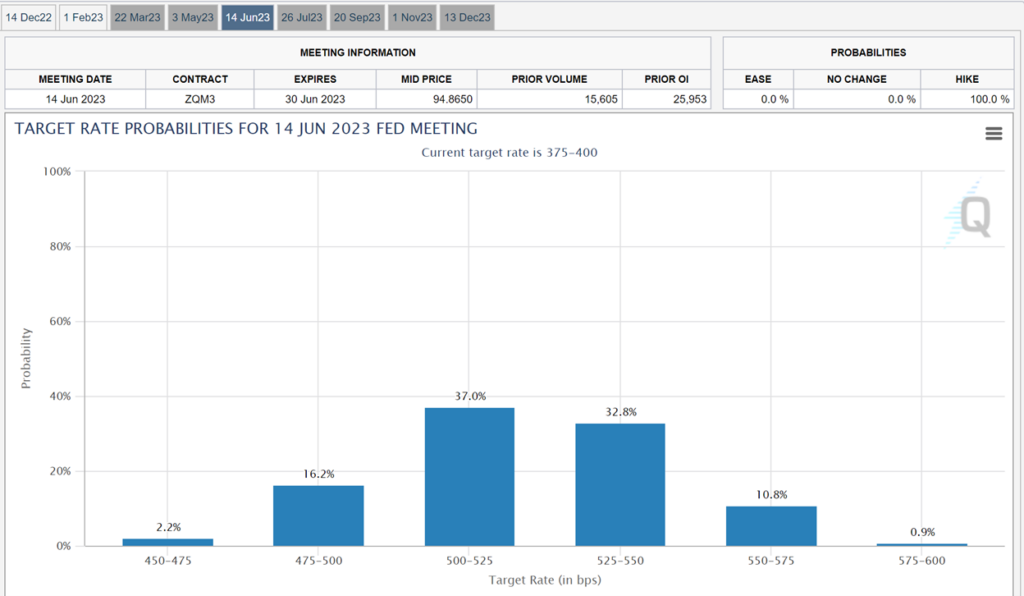

Short-Term Rates Projected to Peak in June at 5.5%

So, where and when will the Fed stop? No one knows for sure, but according to futures markets, (shown in the graph below), short-term interest rates are likely to peak at least at 5.5% in April 2022. Harvard Economics Professor and former U.S. Treasury Secretary, Larry Summers, says short-term interest rates should hit at least 6% if the Fed truly wants to tame inflation. High levels of U.S. interest rates, combined with its existing quantitative tightening (QT) program which shrinks the supply of U.S. Dollars, are likely to keep the U.S. Dollar strong for the near term.

Entering A Seasonally Strong Period for Stocks

Although having the Fed on the interest rate warpath is generally not good news for stocks, we are entering a seasonally strong period (November – January) which may result in the market at least temporarily ignoring some of the macroeconomic headwinds. Midterm elections occur in the U.S. on Tuesday with most betting websites showing the Republicans taking control of at least the U.S. House of Representatives. Financial markets tend to like a “gridlock” scenario, with the balance of power shared between the Democrats and Republicans, since major legislative changes are unlikely to pass. Under gridlock, budget deficits are generally reduced and market forces, rather than governmental fiat, are tasked to solve economic problems.

Although a sustainable rally may not occur until the market fully digests the Fed’s tightening actions and its deteriorating effects on the economy, we are optimistic for returns on most financial assets in 2023. In our view, inflation has peaked, rate hikes are decelerating, and will be coming to an end at some point in the new calendar year. The third year of a presidential cycle is usually bullish, and most bear markets don’t last more than a year on a peak-to-trough basis. Among the reasons for the stock market rally near the end of last week was ongoing speculation of China softening its zero-tolerance COVID policy. Accordingly, commodity stocks were among the biggest winners last week. If China does indeed soften its COVID policy, it would provide further fuel for a 2023 market rally.

We still favor Value and high-quality growth stocks. Alphabet/ Google is an example of the latter. With Alphabet and similar names, we make the distinction between cyclical and secular headwinds. The firm is facing a cyclical downturn in ad spending, while its moat in the search business remains exceptionally strong despite additional regulation potentially facing big Tech on a global basis. We encourage investors to remain patient and buckle up for a bumpy, but ultimately profitable, ride.

Related

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]

Future of thematics is multi-asset

When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths. Instead, we argued that the […]