WELREX® Director John Longo shares his view on the latest meeting of the Federal Reserve

The Federal Reserve raised interest rates 25 basis points last week, bringing the Fed Funds rate to 5.25%, a generational high. Equity markets rallied modestly on the news after parsing the Fed’s published statement. For the first time in several months, the Fed dropped from its statement the phrase that “the Committee anticipates that some additional policy firming may be appropriate.” If it looks like a pause…

The Fed’s behavioural error

The Fed has acknowledged what is obvious to most consumers. That is, it was late in addressing the inflation problem. In an effort to put the inflation genie back in the bottle, the Fed embarked on its most aggressive rate hike campaign since the 1980s. When most people make a mistake, they try not to make the same mistake twice. Hence the Fed sharply increased short-term interest rates to try to stomp out inflation. But most critical analyses of the data show that inflation is coming down and there is nothing magical about the Fed’s 2% inflation target. In fact, inflation has averaged more than 3.5% in the U.S. since the early 1900s and the economy has functioned well, by and large. In short, the Fed is fighting the last war, increasing the odds of recession and acting as a catalyst for the regional banking crisis.

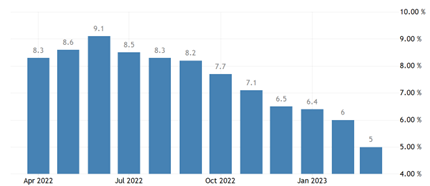

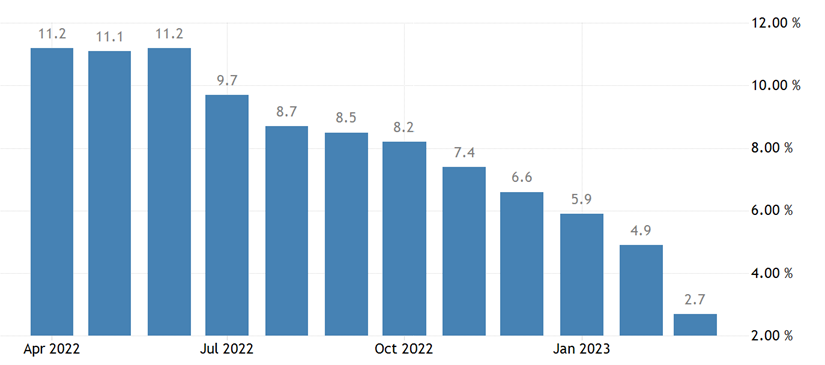

CPI and PPI both falling

Both the Consumer Price Index (CPI) and Producer Price Index (PPI) are noticeably falling, as shown in the graphs below. On a month-to-month basis the numbers may be quite volatile, but as we have discussed in our prior writings, the numbers are very likely to continue their downward trajectories due to the base effect. As we approach the summer, the high CPI and PPI numbers will roll off, making it a virtual mathematical certainty that inflation will continue to fall. Simply because a “double dip” inflation scenario occurred in the past, it does not mean that is has to occur again. Demographic changes and the increased use of technology in our lives are generally viewed as secular deflationary trends.

Consumer Price Index: April 2022- March 2023

Producer Price Index: April 2022- March 2023

Buffett’s comments and a wealth of other slowing economic indicators

Berkshire Hathaway’s legendary shareholder meeting was held last weekend in Omaha, Nebraska. As usual, Warren Buffett and his business partner, Charlie Munger, opined on a variety of topics. Berkshire is probably the world’s most famous conglomerate and hence has a decent view of the U.S. economy. Buffett cited expected earnings declines in 2023 across a range of Berkshire subsidiaries. He also felt deposits in the banking system were safe, but expected issues in the banking system to continue. Importantly, he didn’t say he was buying any banking stocks and simply talked about his existing large position in Bank of America. As a consequence of the regional banking crisis, it is common sense that banks will be lending less, slowing down inflation and the economy.

The inverted yield curve and sluggish Institute for Supply Chain Management (ISM) Manufacturing and Services purchasing manager indicators increase the odds of a recession despite last week’s strong unemployment report ahead of the summer holiday season. Leisure and hospitality jobs accounted for a sizeable portion of the job gains, and these professions generally pay less than those jobs that were lost in the Tech and Financial sectors. The (almost) annual U.S. Debt Ceiling standoff will very likely get resolved, but it may create further market jitters. The Fed continues its quantitative tightening program, which is the equivalent of several rate hikes, over time. In sum, we expect a sluggish U.S. economy with the odds tilted towards a recession due to Fed policy errors. Investment portfolios should be structured accordingly.

John M. Longo, Ph.D., CFA

Director

WELREX®

Related

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]

Future of thematics is multi-asset

When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths. Instead, we argued that the […]