WELREX Director John Longo provides his markets commentary following the July meeting of the US Federal Reserve.

The Fed raised rates 75bps again and U.S. GDP declined for the second consecutive quarter, yet the S&P 500 increased 12% from its bear market low. What’s going on? Let’s rewind while framing recent events and then put it all together with a forward-looking outlook.

Jay Powell Signals The Fed Will Slow Its Pace of Rate Hikes

Let’s start with the Fed. It has a dual mandate – keep inflation contained (i.e., around 2%) and unemployment low. It’s failing miserably at its first task for a variety of reasons but doing a good job on the unemployment front. On the heels of the worst inflation report since November 1981, with the Consumer Price Index (CPI) increasing a blistering 9.1% in June, The Fed followed its June rate hike of 75bps with another 75bps earlier this week. Its hand is forced to keep raising rates until inflation comes down markedly. The U.S. Fed Funds Rate is currently in the 2.25%-2.50% range and futures markets are pricing in another 50bps increase after the September meeting a full 100bps from current levels by year-end to a rate of 3.50%. What does the market like about this interest rate path? It hinges on a sentence Fed Chair Jay Powell uttered in his most recent press conference. Namely, he said, “As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.” Market participants took this phrase to mean the Fed is almost done raising rates, at least with hikes of more than 25bps in magnitude.

It’s Not Yet a Recession, But Likely Heading There

The average investor, and even most financial professionals, think a recession occurs when there are two consecutive quarterly declines in GDP. In fact, the official definition of a recession in the U.S. is more complicated and determined by the National Bureau of Economic Research (NBER). According to the NBER, “A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” So, there you have it from the horse’s mouth. In my view, the current economic slowdown will officially be labeled a recession when the unemployment rate increases. As shown in the graph below, the unemployment rate has held steady at 3.6% for the past 4 consecutive months.

U.S. Unemployment Rate

Source: Trading Economics

When, more than if, the unemployment rate heads up, it should be enough to formally tilt the U.S. economy into a recession according to the formal NBER definition. In my view, it may occur as the year unfolds since consumer spending tends to be somewhat robust during the summer months, especially given all of the pent-up demand from the COVID-19 lockdowns. Despite the surge in energy and food prices, consumer spending has been surprisingly robust, albeit driven primarily by the affluent shopper.

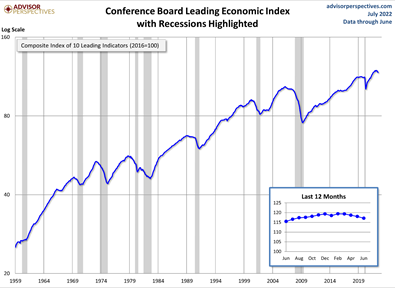

U.S. GDP fell 1.6% in Q1 led by a record trade deficit, which was driven by a strong consumer. In Q2, U.S. GDP fell by 0.9%, driven by a reduction in inventory. Consumer spending actually increased by 1% in Q2. American Express, a proxy for affluent customer spending, claimed via its CEO that it saw no signs of a recession. Despite AMEX’s strength, there are some telltale signs of an impending recession, such as an inverted yield curve and a falling Leading Economic Index (LEI). Although there is some debate about how to measure inversion, the 2-10 year U.S. Treasury spread is most commonly used and it is clearly showing an inversion. LEI has a pretty good track record of pointing down in advance of official recessions, shown in the gray areas in the graph below. LEI has declined for 4 consecutive months, pointing to a weakening economy, not a strengthening one.

Leading Economic Index (LEI) and Forecasting Recessions

Source: Advisor Perspectives

Earnings Are a Mixed Bag So Far with the Cream Rising to the Top

Earnings season is in full swing, with mixed results. One general theme is that the cream is rising to the top, with Microsoft, Alphabet, Apple, Coca-Cola, McDonald’s, and Amazon advancing after their earnings reports. The lesson? The strongest companies can raise prices (e.g., Coca-Cola and Apple) while others (e.g., McDonald’s and Amazon) are benefiting from a “trade down” effect, as consumers tighten their belts. Firms providing unessential services, such as Roku and streaming services, or grappling with competition, such as Intel vs. NVDA/AMD and Meta vs. TikTok, are struggling. Earnings as a whole have been increasing despite the bear market and beaten down expectations among tech stocks, partially due to the bumper crop in earnings from large Energy firms, such as Chevron and Exxon.

Market Outlook: Bumpy, With A 2023 Recovery

Let’s try to piece the conflicting headlines together. First, it is important to recognize that the market is a forward-looking mechanism. So, if a recession lies in the cards, the market tries to estimate when the end of the recession will occur. The average length of recessions since World War II has been about 8-10 months. In my view, the unfolding or next recession will not be worse than the Great Recession of 2007-2009. The stock market historically moves 3 to 6 months in advance of the end of the recession. Therefore, market participants should see light at the end of the tunnel closer to the end of the year, setting up for a stronger 2023. Until then, we suggest an equity portfolio be complemented with uncorrelated asset classes or other types of hedging. We also recommend a dollar cost averaging approach for someone entering the market today primarily with cash. We continue to favor Value and high-quality Growth over speculative growth firms or distressed firms with little to no earnings.

Although most investors badly want the current bear market to be in the rearview mirror, it may take a while longer for stocks to increase another 8% from here, formally kicking off a new bull market. Volatility is likely to remain high until inflation is under control and the Fed completes its rate hike cycle, a process that is likely to take several more months. Increased geopolitical risks, notably with Russia and China, also always have the potential to further delay any market recovery. As sports sage, Yogi Berra, said, “It ain’t over till it’s over.” Position your portfolio accordingly.

John M. Longo, PhD, CFA

Director, WELREX Ltd

Related

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]

Future of thematics is multi-asset

When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths. Instead, we argued that the […]