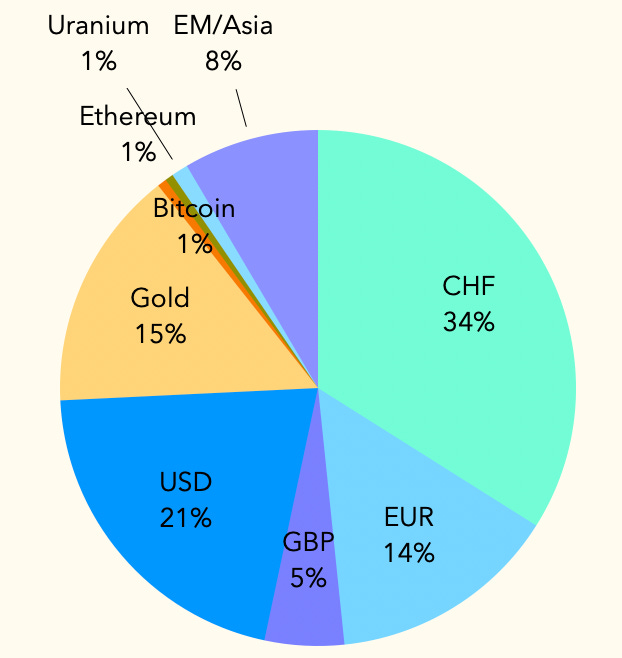

Maintain conservative positioning with half portfolio in Gold and Swiss or CHF-hedged assets; equal allocation between bonds/equities.

By Kirill Pyshkin

Chief Investment Officer of WELREX

We maintain a conservative investment outlook for 2026, characterised by the following positioning:

- Approximately half of the portfolio allocated to Swiss or CHF-hedged assets and gold;

- A broadly equal allocation between equities and bonds, implemented through multi-asset thematic strategies;

- Limited exposure to highly speculative assets such as Bitcoin and Ethereum;

- A less negative stance on U.S. assets and the U.S. dollar compared with 2025;

- A continued negative view on oil, as in 2025, and a newly negative outlook on industrial metals;

- Currency preferences ranked as CHF over USD, USD over EUR, and EUR over GBP.

But before we detail our 2026 investment outlook below, we would like to review the final performance figures for 2025.

2025 performance review

Our multi-asset strategy portfolio delivered +26.5% absolute return in USD, beating all comparative benchmarks. This performance was driven by superior asset allocation and effective instrument selection across all asset classes.

Our main call in 2025 was preference for all European assets including equity, bonds and EUR, with a conservative equal allocation to bonds and equities. We also advocated for gold and CHF as a hedge. Our main calls have proven to be correct.

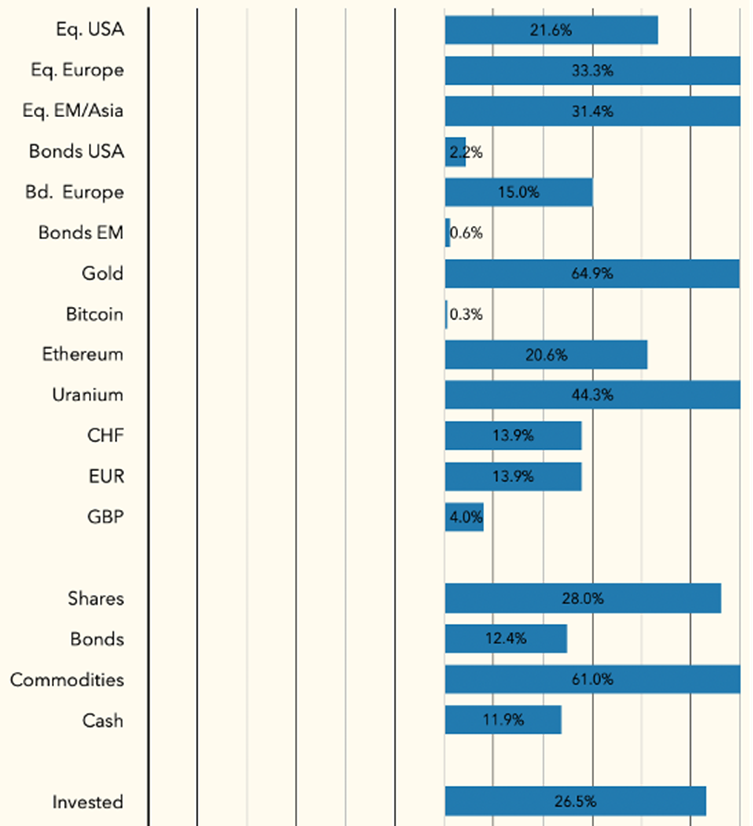

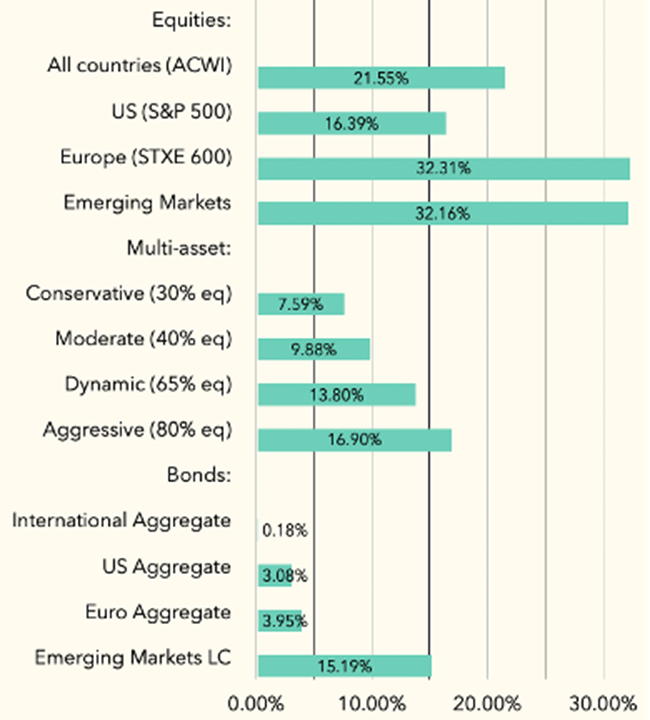

- In 2025 European equities outperformed US and EM equities indices delivering +32.3% vs +16.4% and +32.2%, respectively in USD. Our European equities selection delivered even better +33.3% and our US equities selection a much better +21.6% return. Our EM equities selection delivered slightly worse +31.4%.

- European bonds benchmark outperformed US bonds benchmark delivering +4% vs +3.1% YTD, respectively in USD. But our European bonds selection delivered much better +15%, but slightly worse +2.2% for our US bonds selection.

- EUR and CHF strengthened vs USD by +13.9%. Gold proved to be an outstanding hedge against weak dollar, strengthening by +65% vs USD.

Unusually, all our investment classes are in positive territory. Overall, our multi-asset strategy portfolio has returned 26.5%. This is roughly twice the return of a typical multi-asset portfolio with equal equity/bond allocation, i.e. like ours.

Main reason for such a significant outperformance is our allocation to commodities, with majority in Gold. Our commodities portfolio overall returned 61%, our equities allocation returned 28% and bonds 12.4%.

- Our commodities basket includes Gold +65%, as well as Uranium/nuclear +44.3%, Ethereum +20.6% and Bitcoin +0.3%.

- Our equities basket was up +28%, which compares to +21.6% for the all-countries equities benchmark ACWI. Within equities our US allocation was up 21.6% vs S&P500 +16.4%; our European equities basket was up 33.3% vs STXE600 +32.3%; and our EM basket was up 31.4% vs EM benchmark +32.2%.

- Our bonds basket was up +12.4%. This includes US bonds +2.2% vs +3.1% for the US bonds benchmark; but our European bonds basket was up +15% vs European bonds benchmark +4%; our EM bonds +0.6% vs LC EM benchmark +15.2%.

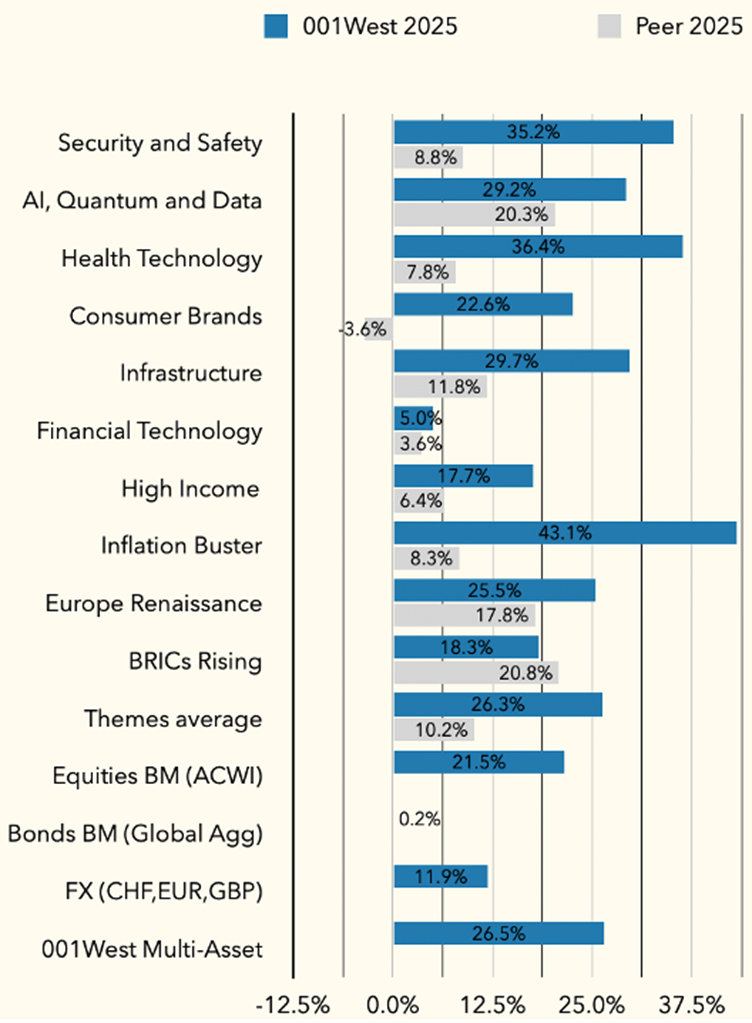

Another prediction that we made earlier this year was that thematic investing will have another difficult year. This indeed was the case. The average of thematic equity funds that we tracked was +10.2%, worse than half the +21.6% return of the general equity index.

Our own thematic portfolios, however, delivered +26.3%, beating the general equities index and peer thematic funds that we track by 2.5x.

Among our thematic portfolios:

- Nine out of ten of our thematic portfolios were up in double digits

- Seven out of ten thematic portfolios beat the general equity index

- Multi-asset Inflation Buster was up 43.1%, more than 5x better than peers

- Equity Heath Tech and Security and Safety returned over 35%, beating peers 4-5x

- AI, Quantum and Data and Infrastructure returned almost 30%, beating peers

Our primary investment thesis in 2025 was a preference for European assets—including equities, bonds, and the euro—combined with a conservative, balanced allocation between equities and fixed income. We also advocated exposure to gold and the Swiss franc as defensive hedges. These core views proved correct.

For 2026, we maintain a broadly similar positioning, with an approximately equal allocation between equities and bonds. Roughly half of the strategy portfolio remains invested in gold and Swiss-franc-denominated assets, including short-duration corporate bonds and defensive equities. This results in a materially more conservative profile than that of a typical multi-asset portfolio.

The elevated asset valuations and rising public debt levels highlighted last year remain unresolved. As a result, we continue to favour a defensive positioning. To offset the risk of excessive conservatism and to preserve portfolio balance, we maintain selective exposure to higher-risk assets capable of generating outsized returns, notably Bitcoin and Ethereum.

Overall, this outlook closely resembles our 2025 stance. The principal difference is that we are incrementally less negative on the United States and the U.S. dollar than we were last year.

In 2025, we argued for the outperformance of European assets—including the euro, bonds, and equities—which subsequently materialised. For 2026, we are less confident that this trend will persist and have therefore increased our allocation to U.S. assets across all asset classes.

United States Outlook for 2026 — Less Negative Than in 2025

In 2026, we believe the United States is uniquely positioned from a macroeconomic perspective. Fiscal policy remains supportive, driven by the One Big Beautiful Bill Act (OBBBA) and continued foreign direct investment following earlier tariff negotiations. In addition, significant tariff revenues are contributing to the reduction of the budget deficit, although there remains a small risk that these measures could be overturned by the courts.

At the same time, the Federal Reserve is likely to adopt a more accommodative stance as economic growth moderates, pushing interest rates lower. The combination of fiscal stimulus and monetary easing is inherently inflationary.

In 2025, our multi-asset “Inflation Buster” theme delivered a +43.1% absolute return in USD and was the best-performing portfolio. We believe this theme may again generate outsized returns in 2026.

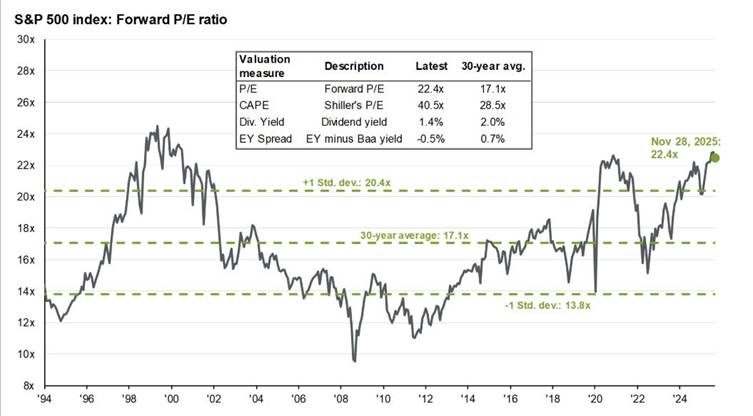

From a traditional asset allocation perspective, this macro environment would favour equities over bonds. However, U.S. equities are expensive, and certain segments—most notably artificial intelligence—exhibit characteristics of a potential bubble. While U.S. equities were already expensive last year, valuation concerns have shifted from expectation-driven multiples toward a requirement for tangible earnings and cash-flow delivery from AI-related investments.

Source: Bloomberg, JP Morgan S&P 500 Valuation

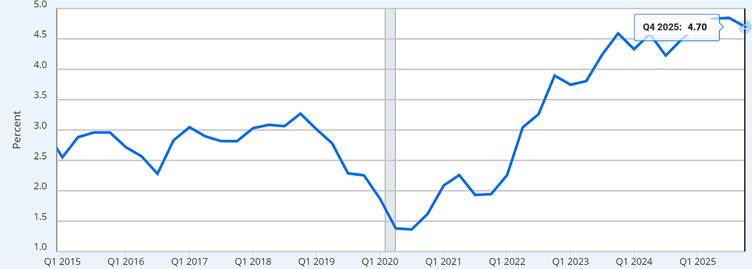

Accordingly, while we prefer equities over bonds in the U.S., we maintain exposure to both for risk management purposes. Within fixed income, we favour long-duration U.S. Treasuries, where yields remain unusually high. In equities, we focus on thematic and selective opportunities, favouring active management over broad market exposure, with an emphasis on strong balance sheets and clear monetisation pathways.

Figure: Long-duration (30Y) US Treasury market yields %

Source: Board of Governors of the Federal Reserve System (US) via FRED

Overall, the U.S. investment landscape in 2026 combines strong macro support with demanding valuations. Future returns are likely to be more fragile and potentially lower unless growth and earnings expectations are met. This environment favours active management, disciplined security selection, and a focus on fundamentals rather than narratives.

Europe Outlook for 2026 — Preference for Safer Swiss Assets

We view Switzerland as the safest region within Europe, and CHF-denominated, CHF-hedged, or Swiss-headquartered assets represent our largest regional allocation.

Exposure to the euro area is more limited and focused on long-duration euro-denominated government bonds, which serve as a higher-risk hedge relative to our ultra-defensive Swiss holdings.

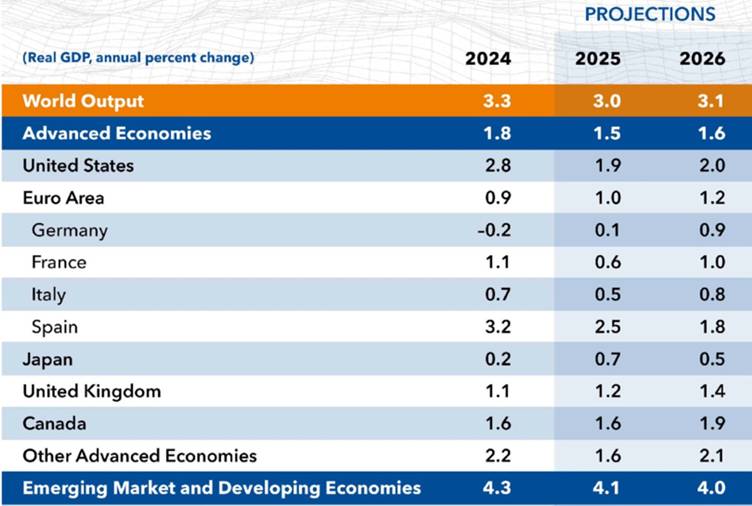

While European equity valuations are lower than those in the U.S., weaker growth momentum, thinner margins, and limited visibility into AI-driven earnings constrain broad-based upside. As a result, our equity exposure in Europe is thematic and selective, focusing on areas benefiting from incremental spending, such as German infrastructure, or on globally competitive European companies.

In the UK, our exposure is concentrated primarily in corporate bonds, with equity exposure focused on the energy and industrial sectors.

Figure: Global economies growth forecast

Source: IMF, World Economic Outlook Update July 2025

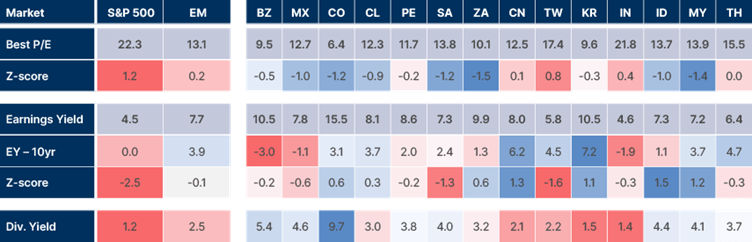

Emerging Markets Outlook for 2026 — Selective Opportunities

Emerging markets enter 2026 with stronger fundamentals than in recent years; however, the opportunity set is increasingly fragmented. Following a strong performance driven by falling inflation, early rate cuts, and currency stabilisation, much of the broad emerging-market beta has already been realised.

Going forward, returns are likely to be driven by country-specific factors, balance-sheet strength, and policy credibility. Our exposure to emerging markets therefore remains measured and selective, implemented through our thematic multi-asset “Rising BRICs” portfolio, which is structured at approximately 60% equities and 40% bonds.

Within emerging markets, we see attractive risk-adjusted opportunities in fixed income over the near to medium term. Hard-currency and high-quality local-currency bonds benefit from improving fundamentals, attractive carry, and declining inflation. Consequently, our exposure to India is currently expressed exclusively through bonds.

On the equity side, our largest exposure is to Brazil, where valuations remain reasonable and earnings are supported by domestic reform momentum. Exposure to China remains limited and highly selective. Structural challenges—including weak domestic demand, a property sector overhang, and ongoing geopolitical frictions—continue to weigh on growth visibility. While policy support may mitigate downside risks, we see limited potential for sustained upside in Chinese equities in 2026.

Figure: P/E; earnings yield (EY) and EY – 10yr govt: S&P; DM ex-US; MSCI EM; and largest MSCI EM countries

Source: MSCI, Ashmore, Bloomberg. Data as at November 2025

Overall, emerging markets offer asymmetric opportunities rather than uniform upside, reinforcing our preference for an active and balanced approach.

Commodities and Currencies Outlook for 2026 – Still Negative on Oil

We welcome ongoing peace talks related to Ukraine. However, we expect that any peace agreement would likely involve the easing or removal of sanctions on Russia. Given Russia’s role as a major global producer of oil, gas, industrial metals, precious metals, industrial gases, and chemicals, an increase in supply would exert downward pressure on prices.

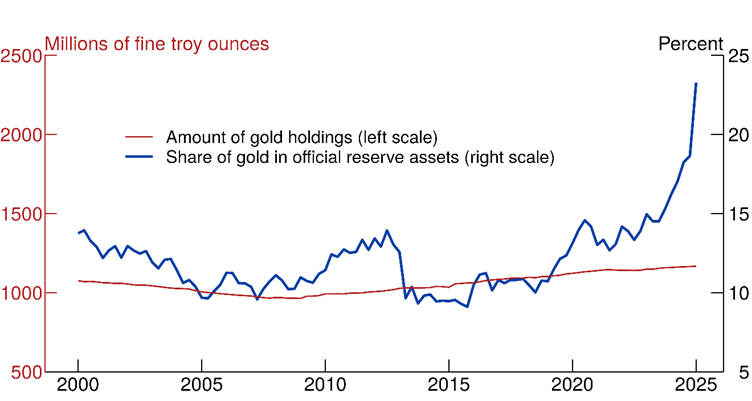

While reconstruction efforts in Ukraine may generate additional demand for industrial metals, we do not believe this will be sufficient to offset the impact of increased supply. As a result, we maintain a negative view on most commodities, with the exception of gold, where demand—particularly from China’s central bank —remains strong and largely unaffected by sanctions.

Figure: Share of gold in official reserves (market value as a percent of total reserves)

Source: IMF International Financial Statistics and FRB

Currency Outlook for 2026 – Preference for Swiss Franc

Gold and cryptocurrencies represent opposite ends of the risk spectrum. We consider gold to be low risk, while cryptocurrencies are extremely high risk. Nonetheless, both serve as hedges against fiat currencies at a time when confidence in paper money has weakened.

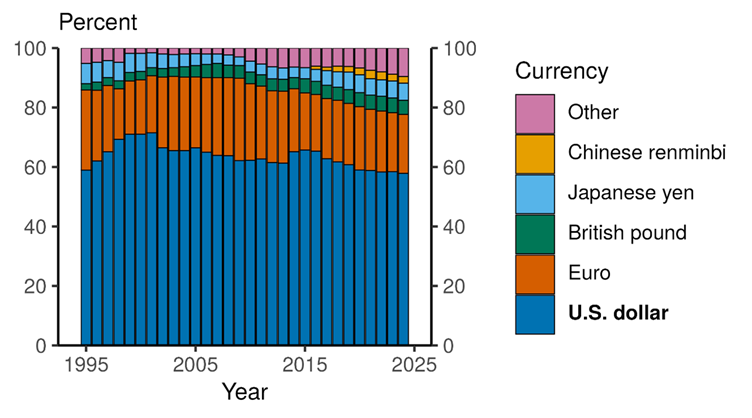

In our 2025 outlook, we discussed the “weaponisation” of the U.S. dollar, referring to the increasing willingness of the U.S. to restrict dollar usage by regimes it deems hostile. This has contributed to a gradual erosion of the dollar’s share in central bank reserves, a key driver behind the sharp rise in gold prices.

Similarly, the European Union has demonstrated a willingness to consider the expropriation of Russian central bank reserves held in euros. Although recent attempts were blocked, the precedent has been established, and we expect the euro’s share of global reserves to decline over time.

Figure. Share of globally disclosed foreign exchange reserves (1995-2024)

Source: IMF COFER and FRB

For central banks, gold remains the primary alternative. Silver is less attractive due to storage constraints, leading some institutions to consider cryptocurrencies as a supplementary reserve asset. The long-term outlook for crypto is further supported by increasing institutional adoption, facilitated by improved access through ETFs. While we remain long-term positive on cryptocurrencies, their volatility makes them unsuitable for risk-averse investors.

Among fiat currencies, the Swiss franc remains our top choice, reflecting Switzerland’s ability to avoid populist policy shifts. In contrast, we hold a negative view on the British pound. Between the U.S. dollar and the euro, we prefer the dollar in 2026, believing that its 13.9% depreciation against the euro in 2025 was excessive and rapid. We also view the impact of U.S. tariffs as broadly positive, supporting foreign direct investment and fiscal revenues.

Conclusion

Our 2026 investment strategy prioritises capital preservation, selective risk-taking, and asymmetric return opportunities. While remaining defensively positioned, the portfolio retains exposure to assets capable of delivering outsized returns, as demonstrated in 2025.

Acknowledgement

We would like to thank our interns, and particular Phalguni Sanghi from the 2025 Cambridge Master of Finance Programme, for their valuable research assistance, data collection, and analytical support in the preparation of this outlook.

Disclosure

This article represents my personal opinion and is provided for information purposes only. Its content is not intended to be an investment advice, or a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. I use information sources which I believe to be reliable, but their accuracy cannot be guaranteed. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors and, if in doubt, an investor should seek advice from a qualified investment advisor.

Related

Quantum technologies: the next digital revolution

Kirill Pyshkin Investors fear the quantum concept as an unknown quantity, but once they analyse case studies around its transformative nature, it is likely to rival the potential of AI © Envato This article was published in PWM, and FT-affiliate publication, on 14 Nov. 2025 The year 2025 marks a century since quantum mechanics reshaped […]

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]

Future of thematics is multi-asset

When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths. Instead, we argued that the […]