When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths.

Instead, we argued that the US equities will take a breather and better returns may be available elsewhere. We suggested equal allocation to equities and bonds but with a preference for Europe over the US, and EUR over USD. We were concerned about early signs of the slowdown in the US economy but with persistent inflation and proposed gold and CHF as a hedge. We were cautious on commodities, and in particular oil.

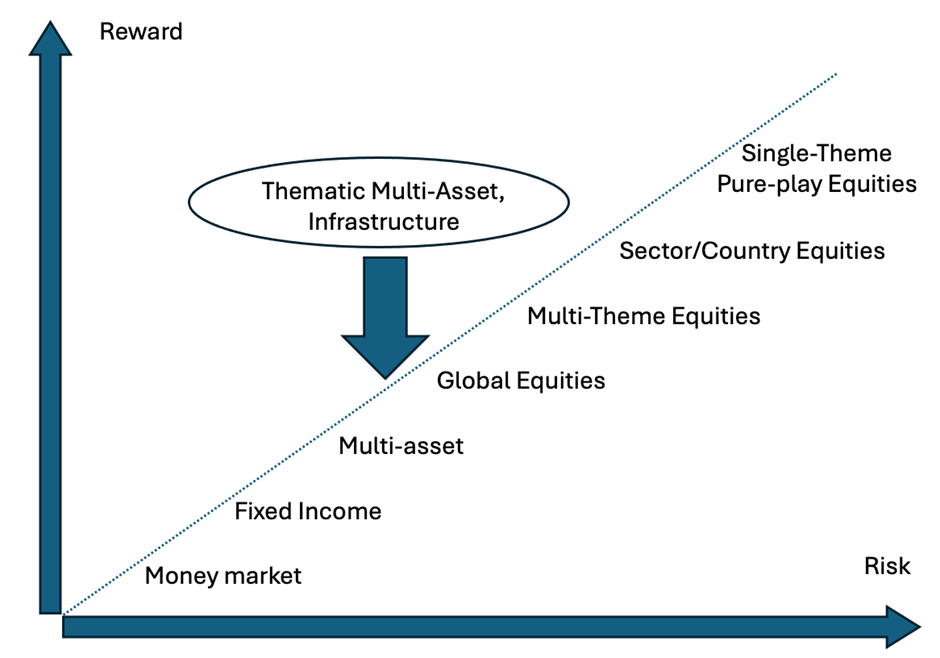

Multi-asset portfolio allow access to macro views

To give clients easy access to those views through simple investable products we launched a thematic family of portfolios on 31.12.2024 under the brand name One Second West (0°0’1″W), including innovative thematic multi-asset portfolios.

We expected that multi-asset portfolio, which is a mix of equity, bonds and sometimes other asset classes would prove to be less risky than pure equities, and, therefore, offer more downside protection during market volatility, which we expected in 2025.

Source: www.001west.com, adapted after UBS, see chart on p15 of the report

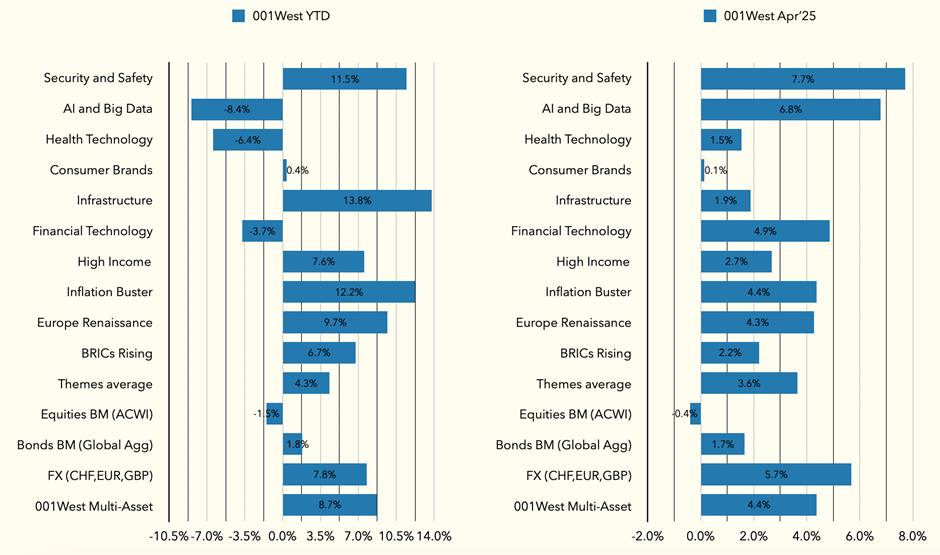

Spookily, all our macro predictions have proved to be correct so far, and our overall multi-asset strategy portfolio created to benefit from those predictions was up +8.7% in 2025 to end of April in USD. This is significantly better than the -1.5% return from global equities and +1.8% return from global bond benchmarks in USD over the same period.

Multi-asset thematics held well through recent volatility

Our pure equity themes returned on average +1.2% to 30.04.2025, better than the -1.5% thematic peer average return and the return from ACWI, all countries world equity index. However, our unique multi-asset thematic portfolios were the real standout performers through volatility after the “liberation day”, returning on average +9.1% in USD in the year to end of April. Even if we compare those to a 50/50 blend of bond and equity funds in the same themes, the peer average would be only +3.4%. So we did much better on average, which is at least partly the result of our excellent instrument selection. But the return was consistently more positive in our multi-asset portfolios. In comparison, the return of our pure equity portfolios greatly varied because they are more risky.

001West Thematic portfolio performance to 30.04.2025

Among our themes – Infrastructure, Inflation Buster and Security and Safety thematic portfolios remained the best performers year to date even after the period of market volatility and simultaneous sell off in equities and bonds in April.

Our thematics express geopolitical views

Excellent performance of those specific portfolios can be explained with the idea that we are operating at the intersection of geopolitics and economic interests. A recent paper from a trio of American economists — Christopher Clayton, Matteo Maggiori and Jesse Schreger — outlines the growing field of “geoeconomics”, inspired by Albert Hirschman, author of a book published in 1945, National Power and the Structure of Foreign Trade.

For example, the best performers among our equity thematic were Infrastructure and Security and Safety portfolios, which is not surprising given the Germany’s plans to invest upto €1trln in infrastructure and defence. We have majority European exposure in our Infrastructure portfolio and a large allocation to Defence in our Security and Defence portfolio. We don’t see reduction in defence in infrastructure spending anytime soon and therefore good returns from this theme should continue.

Inflation Buster and High Income are multi-asset portfolio designed to shield from US inflation though investments in assets that historically went up with inflation and those that generate inflation-beating income. For example, our High Income portfolio generates 5.4% gross/4.9% net annual income in addition to 7.6% capital return that it has delivered year to end of April in USD. While our Inflation Buster portfolio delivered 12.2% return to 30.04.25 but it has a smaller annual income component. We believe this will remain a genuinely very attractive proposition in period of elevated inflation.

Our Rising BRICs and Europe Renaissance multi-asset portfolios are created to reflect the new multi-polar world that is taking shape. On the one hand Europe is forced to pick up the baton from the US, which is focussing on its own agenda. On the other hand, BRICs / “Global South” is aspiring to become the other pole in a multi-polar world. We believe these trends will be developing at least over the next few years. Our multi-asset portfolios consist of a selection of local currency bonds and equities from those respective regions that should benefit, if we are correct in our predictions.

Our equity thematic portfolios AI and Big Data, Health Technology, and Financial Technology that were out of favour until April, have suddenly sprang into action. Since the “liberation day” to today (20.05.2025), two of them are now the best performers overall, surpassing all our multi-asset portfolios. Equity factors could dominate returns of pure equity thematic portfolios as we explained in our January article .

This is exactly why we created multi-asset thematic portfolios, which are less sensitive to equity factors, thus more resilient through periods of volatility and less risky. Of course, during periods of bull market runs, volatility is viewed positively, which is why pure thematic equity portfolios may overshadow less risky multi-asset thematic.

Investment conclusion

Our unique multi-asset thematics are proving to be less volatile than our pure thematic equity portfolios. But we believe in the relevance of all our themes for years to come. They have different degree of geoeconomics, from very high geopolitical component in our multi-asset portfolios, to more pure economics in our equity portfolios, such as the idea that it is digitalisation that drives cost savings in most sectors.

As for our macro view – we remain positive and continue to expect further benefit to all European assets, from the settlement of the Ukraine conflict later this year. Since the tariff announcement we have also become incrementally more positive on the US after somewhat indiscriminate sell off. We used this sell off as an opportunity to add to many of our positions, making some changes to our portfolios, which we may announce in due course.

Important disclaimer

This article is provided for information purposes only. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation, or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment advisor.

Related

Quantum technologies: the next digital revolution

Kirill Pyshkin Investors fear the quantum concept as an unknown quantity, but once they analyse case studies around its transformative nature, it is likely to rival the potential of AI © Envato This article was published in PWM, and FT-affiliate publication, on 14 Nov. 2025 The year 2025 marks a century since quantum mechanics reshaped […]

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]