In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

Thematic funds fall from grace

Thematic funds are a way to invest in an investment theme or an emerging megatrend that you believe has the potential to deliver superior returns, for example, Artificial Intelligence (AI). However, they have suffered 3 years of underperformance.

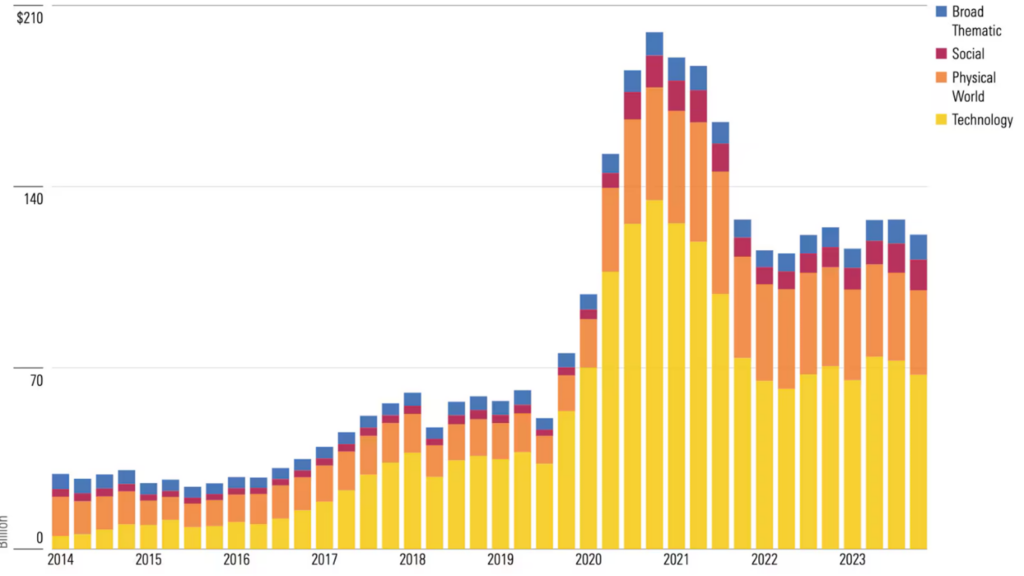

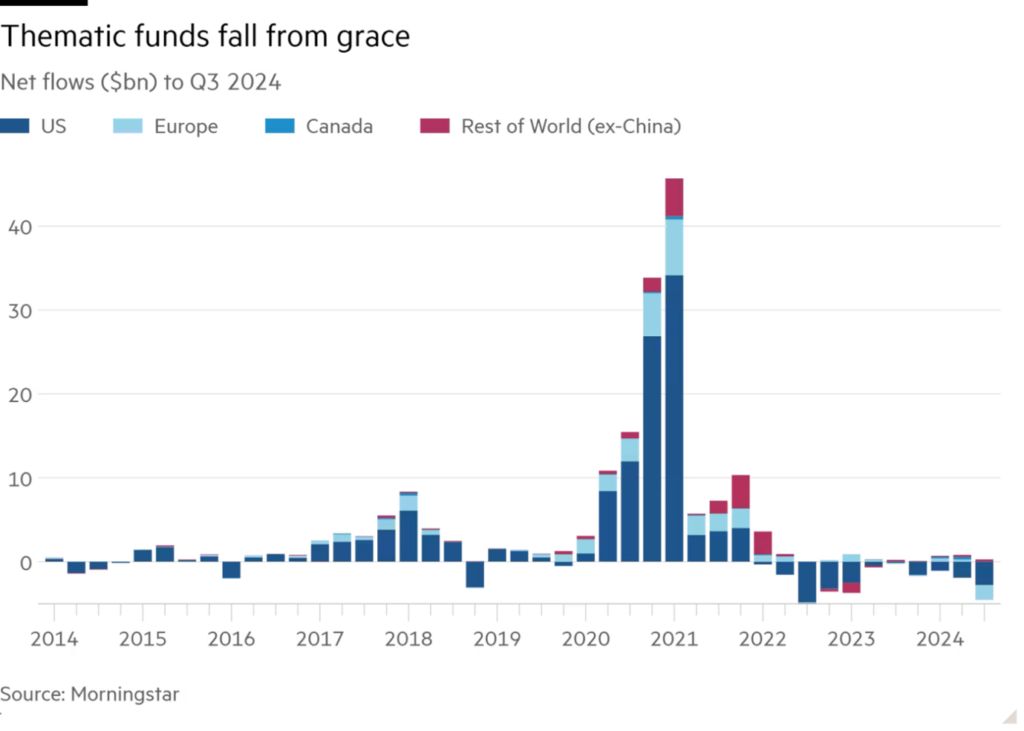

Assets under management (AuM) in thematic equity funds more than tripled during COVID-19, peaking in mid-2021 at about $200bn, including $86bn of inflows. But after the terrible performance in 2022, AuM fell to about $120bn and never really recovered with $18bn outflows in 2023 and 2024 offsetting the broader market recovery.

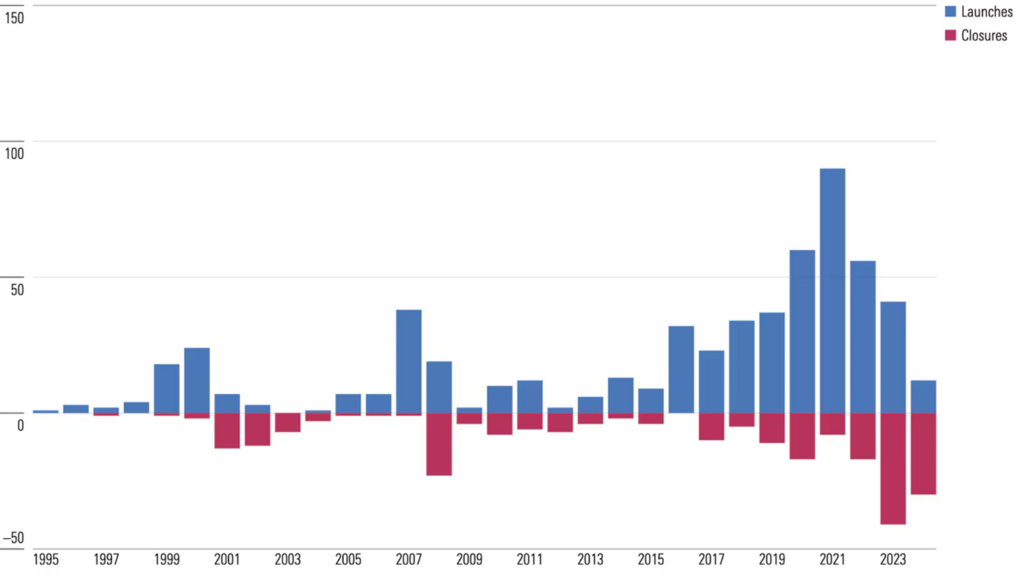

In 2024, despite the S&P 500 having one of its best years on record, nonetheless over 70% of the largest thematic ETFs failed to beat the S&P 500. The average return across the entire thematic universe was around 16% compared to the S&P 500’s return of 23%. In the first half of 2024, thematic fund closures outnumbered new funds launched for the first time.

Source: https://www.morningstar.com/funds/thematic-fund-landscape-7-charts

Source: FT https://www.ft.com/content/eef24b62-9d4b-4eb9-9819-04bc922fc3fb?shareType=nongift

Source: https://www.morningstar.com/funds/thematic-fund-landscape-7-charts

Why 2022 was such a terrible year?

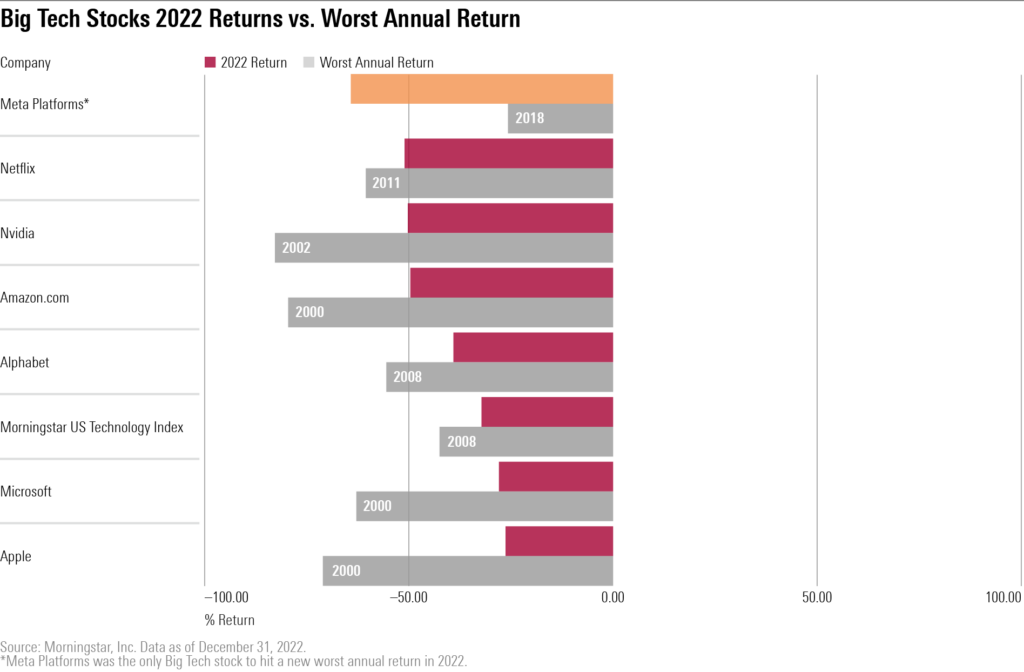

2022 was the worst year for equities since 2008, with the S&P falling around 20%. But technology stocks fared even worse, losing 31%. The communications sector including Google and Facebook fell 41%. It was also an absolute disaster for what is known as the magnificent 7 in the following years – Tesla fell -65%, Meta -64%, Netflix, Nvidia, Amazon about -50%. The magnificent stocks didn’t look so magnificent back then.

One could also argue that the following two years of great performance from those stocks was just a recovery from a huge sell-off and there is nothing special about them as companies. Thematic equities heavily focus on technology stocks because digitalisation typically drives innovation in most sectors. As a result, 2022 was a heavy blow for thematic equity funds, from which it is yet to recover.

Source: https://www.morningstar.co.uk/uk/news/230635/so-just-how-bad-was-2022-for-us-investors.aspx

Coincidently in 2022, Bitcoin also lost over half its value. One could conclude that investors simply lost their will to invest in risky assets in 2022. However, what was special about 2022 was that it was also a very bad year for bonds, which are a risk diversifier to equities. The US government and investment-grade corporate bond market lost 12.9% in 2022, one of its biggest annual losses on record.

Move in interest rate is an important factor for thematic equities

The common variable that influenced bonds, stocks, and especially higher growth technology stocks, was rising US rates as the Fed started tightening. US 10-year yield doubled during 2022 from 1.8% on 1.1.2022 to 3.5% on 1.1.2023.

In other words, in 2022 it didn’t matter whether you correctly identified a winning megatrend, or even diversified across the themes investing in the future of mobility with Tesla, the future of AI with Nvidia, or the future of FinTech with blockchain and crypto investments. You still would have lost half your money.

Themes often trade together because the common factor is higher growth. For example, as of mid-2024, 66% of US thematic funds landed on the growth side of the Morningstar Style Box, while just 11% fell on the value side. Growth is valued differently in different interest rate environments. Mathematically, the higher the interest rate, the lower the value of future cash flows. This means that when rates are rising thematic investing has a powerful headwind.

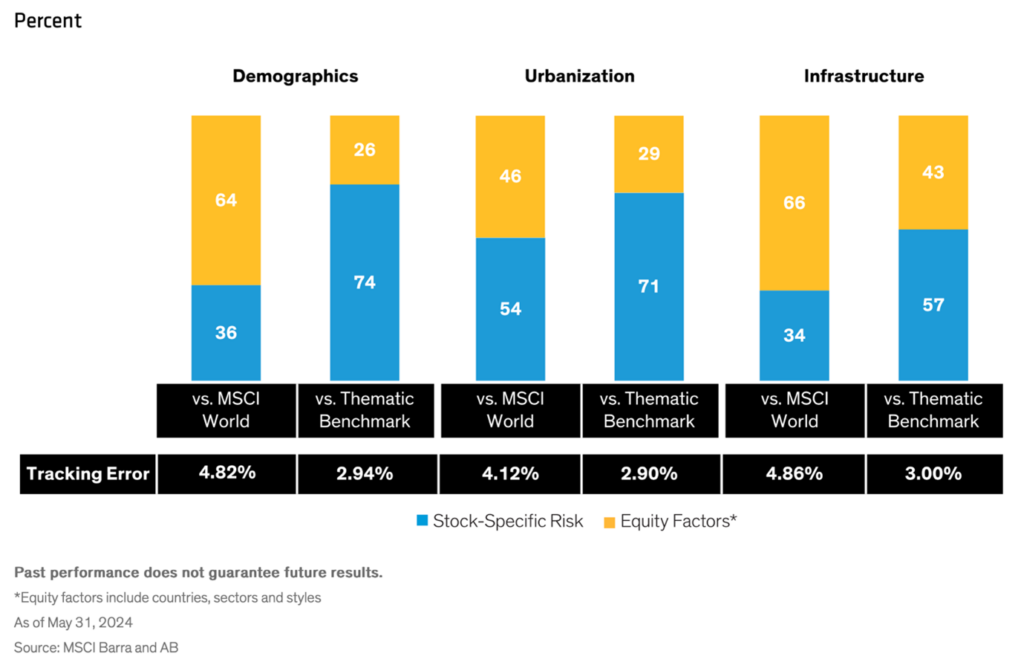

Factors overwhelm stock selection

According to AllianceBernstein, factors account for between half and two-thirds of total thematic equity portfolio returns when compared to the broad equity index. That means that, for example, it may be even more important to get the balance between growth and value right, than to pick the actual individual stocks. It is a sad statement for stock-pickers and another argument against actively managed funds. This is also why broader ETFs and passives in general are growing in popularity.

Of course, against the specifically developed “thematic benchmark” stock picking becomes more important – but who cares about those benchmarks other than those who develop them? They may be useful for measuring the performance of fund managers to reward them appropriately but not more. The whole idea of thematic investing is sold on the premise that those powerful themes could deliver better returns than overall equities and therefore they should be measured against the broadest equity indices, in my opinion.

Could 2025 be better for thematic equities?

Since 2022, the 10-year US yield continued to rise slowly, increasing by 60bps to 4.1% on 1.1.2024 and then another 50bps to 4.6% on 1.1.2025. The rate of the yield increases slowed and coincidently the performance of thematics was better. Therefore, the performance of thematic strategies in 2025 heavily depends on the direction of the interest rates. If we expect falling rates in 2025, it could be a much better year for the performance of thematic equities.

However, in our investment outlook for 2025 published in November, we expressed concern about inflation in the US, which means rates may stay higher for longer. Over the past two years, the S&P500 has climbed 53%, marking one of its strongest two-year performances since the late 1990s. Statistically, it would be very unlikely for such strong equity performance to continue in the US. In our outlook, we also noted that US equity valuations, and, in particular, in the technology sector are extremely high. Therefore, given the high concentration of US technology stocks inside traditional thematic equity portfolios they are also unlikely to perform well.

Thematics still offer a very sound way to invest in emerging megatrends that should deliver positive returns over the long term. Digitalisation is still the driver behind innovation in most sectors and therefore technology stocks would still have to feature prominently in thematic funds. However, in my opinion in 2025, one should be very careful with selecting stocks that are not trading on extreme valuations. Moreover, as we suggested in our outlook it would make sense to look at other regions where valuations are not as extreme and find other ways to diversify risks, where possible.

Kirill Pyshkin, Chief Investment Officer, WELREX, 6 January 2025

Important disclaimer

This article is provided for information purposes only. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation, or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment advisor.

Related

Investment Outlook 2026

Maintain conservative positioning with half portfolio in Gold and Swiss or CHF-hedged assets; equal allocation between bonds/equities. By Kirill Pyshkin Chief Investment Officer of WELREX We maintain a conservative investment outlook for 2026, characterised by the following positioning: But before we detail our 2026 investment outlook below, we would like to review the final performance […]

Quantum technologies: the next digital revolution

Kirill Pyshkin Investors fear the quantum concept as an unknown quantity, but once they analyse case studies around its transformative nature, it is likely to rival the potential of AI © Envato This article was published in PWM, and FT-affiliate publication, on 14 Nov. 2025 The year 2025 marks a century since quantum mechanics reshaped […]

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]