The WELREX investment team takes a view on what’s to come in 2024

Review of 2023 Forecasts

Before we look ahead to 2024, allow us a moment to glance back at the prior year in the context of our forecasts published on January 5, 2023. WELREX has an absolute return investment philosophy for most of its clients, so following a period of severe weakness for many risky assets in 2022, we recommended a widely diversified portfolio with an outsized allocation to alternative investments in 2023. In general, this was sound advice in a year where almost all asset classes rose significantly.

Our favoured allocation to alternatives proved to be sage advice. The best-performing alternative asset class that we positively discussed in our article was cryptocurrency. Bitcoin and Ether, the two leading cryptocurrencies by market capitalization, were up roughly 155% and 95% respectively in 2023, perhaps resulting in our best forecast. Hedge Funds, Private Equity, Private Credit, Gold, and other Commodities logged acceptable returns but trailed most broad equity indexes.

From a macroeconomic perspective, we thought inflation would fall, but remain sticky, which was indeed the case throughout most developed markets. Nevertheless, most fixed-income securities generally delivered positive real returns by year-end, resulting in another modest win. Our biggest “mistake” was suggesting that Value would outperform Growth in 2023. Both indexes delivered double-digit returns but, of course, The Magnificent 7 had a tremendous year in the U.S. to lead Growth stocks. However, we did specifically cite opportunities in Meta (+197%), Alphabet (+59%), and PayPal (-12%) in our article, since these stocks had fallen into Value territory by some metrics after a disastrous 2022.

United States: Sluggish Economy = Volatility + Fed Rate Cuts, Stronger Economy = No rate Cuts

The U.S. economy has cooled from its fast pace in Q3 of 4.9% real GDP growth to a sluggish pace in Q4, tracking at roughly 1% GDP growth. Where it travels from here is subject to vigorous debate. In our view, when companies start to report 2024 earnings outlooks in a few weeks the outlook will be modest for most firms. A tepid outlook may result in heightened volatility, which is starting from a low base with VIX currently at 12.5. Nike’s recent downbeat earnings report may provide a clue of what’s in store for many firms that rely on global consumers for their livelihood. We think the odds point to continued sluggish to mildly negative growth, rather than a reacceleration to the upside. Equity gains in the U.S. may be capped on the upside to earnings growth, which is currently tracking at about 10%.

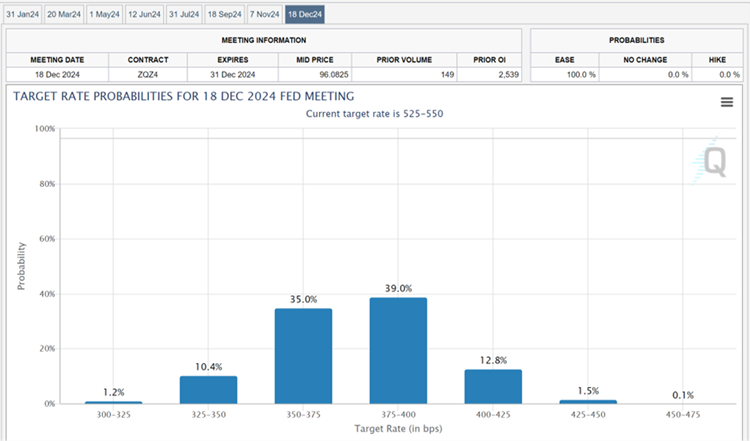

As usual, the Fed will come to the rescue if things look bleak, but we believe the pace of cuts depends on the severity of any downturn. An improving economy on the other hand could lead to inflation risks, which could negatively impact companies with high operational costs. In a “soft landing” scenario we see a few rate cuts, perhaps in aggregate of roughly 100 basis points. In a recession, we think the Fed will seek to un-invert the yield curve, resulting in at least 150 basis points of cuts. Futures markets are pricing in the more aggressive rate-cut scenario, as shown in the graph below. In both scenarios, we see the U.S. Dollar weakening vs. the Dollar Index (DXY) once the rate cuts begin, however, if rate cuts in the EU and UK happen at the same pace as in the US or faster, then the relative value of USD versus Euro and GBP may hold up. 2024 might see some of the market expectations on growth get moderated as high expectations for a soft landing and on themes like AI get more realistic.

Projected Fed Funds Rate Probabilities: December 2024

Source: CME Group

Although the Fed is politically independent by charter, election-year politics cannot be completely ignored as the U.S. central bank charts its rate-cut path. Despite the wars ongoing in Ukraine and Israel, we expect both the Democrat and Republican parties to at least temporarily scale back their involvement in foreign policy activities and to prioritise the domestic economic agenda to win voter sympathy.

Inflation – going, gone or here to stay?

Inflation doesn’t seem to be a major concern for the markets anymore, which is both good news and bad news. Good news because the double-digit inflation which we saw in the early part of 2023 looks well and truly over for the US and most Western economies and markets are looking forward to the normalisation of interest rates. Bad news because the markets are pricing in a quick and orderly return to the central bank target of 2% inflation, however the few data points which are available on past episodes of double-digit inflation show that inflation can persist in unexpected ways and there can be a second flare-up of inflation into the high single digits which can catch most market participants by surprise.

Equity Market sentiment has become quite bullish since October on expectations of a soft landing and interest rate cuts, and there may be some moderation of sentiment and contraction of equity valuation multiples in the US once the year-end effect subsides. Economic slowdown may test the nerves of the stock market and 20%+ dips are not ruled out. Sectors with high valuation multiples like Tech which have seen large gains in 2023 could give back some of those gains, especially for those names where the price gain has not been accompanied by increased earnings.

Fixed-income markets have seen a sharp fall in long-term bond yields on expectations of a Fed rate cut. Any signs of a second spike in inflation can put bond prices under pressure and delay the timing of rate cuts by the Fed.

Credit Spreads remain priced roughly in line with historical averages and should remain supported as company balance sheets remain comfortable.

Commodities could surprise on the upside, especially in Oil and the Energy complex which has seen significant price decreases over the past few weeks, if geopolitical tensions in the Middle East or elsewhere disrupt supply or if the expected shale output does not increase as expected and the OPEC+ continue with their supply cuts. Gold may continue shining to the upside especially if inflation remains stubborn and economic deceleration happens quicker or deeper than expected.

The potential inflation spike in 2024 is a topic of increasing importance in the global financial landscape. Just to remind that the key aspects from an investment perspective include the response of central banks worldwide, as they may adjust interest rates to control inflation, influencing borrowing costs and potentially affecting corporate profits and economic growth. Additionally, inflation can lead to increased volatility in bond markets. Furthermore, inflation can impact consumer spending and corporate pricing power, influencing the performance of consumer-related sectors. It’s also important to note that inflation rates can vary significantly across different countries, affecting international investment strategies and currency markets.

The European Union and United Kingdom: Europe’s Central Banks May Follow Fed Rate Cuts

The GBP and EUR both strengthened following the Fed’s dovish tones in mid-December. The subsequent stock market rally in these jurisdictions has not been as strong as in the U.S. but feels somewhat disconnected from the appreciation of the currencies. GBP inflation, previously sluggish in its downward trajectory, is now broadly in line with the rest of Europe and the U.S. But whilst all 3 centres’ core inflation is less than 4%, they are still above 3% and therefore outside of the historic central bank tolerance of roughly 2%. The chart below shows a much stronger GBP appreciation following the Fed’s announcement vs. the drop in CPI in December.

Source: XE.com

In the UK, the timing of the election is unknown, but odds-on for the last quarter. However, the full force of the rate rises on the primarily fixed rate mortgage market is yet to fully filter through in a significant way to repossessions/consumer spending. Some 1.6m fixed rate maturities are expected in 2024 (1.5m in 2023) and the longer rates stay elevated and the later the election is, the worse off the electorate will feel. Officially, there will not be any coordination between monetary and fiscal policymakers.

The BoE has recently mirrored, along with other regional central banks, the Fed’s policy moves, but not necessarily its policy language. This relationship is expected to continue into 2024. However, economic growth will be severely tested in 2024. Whilst unorthodox approaches must be avoided, particularly following the destabilisation of the Gilt market in 2022, bigger-than-expected corrective action may yet be needed by the European central banks. Germany, the engine room of the EU and the UK, with its election sensitivities in the coming year, will be seeking to avoid overly acute slowdowns. But inflation could prove persistently sticky over the “last mile” coupled with employment levels continuing to prove resistant, which may support consumer spending.

Europe (with the notable exception of Hungary) has been mirroring U.S. foreign policy due to deep military and economic dependence on the U.S. Europe is entering an election year. As discussed earlier, this development would ordinarily refocus geopolitics on domestic priorities. Stock market returns in the EU and the UK however are likely to remain muted in 2024.

Asia: China’s Turmoil Creates Opportunities in Emerging Markets

China is dealing with some fundamental problems as it grapples with the aftermath of a real estate crash, ageing demographics, declining foreign direct investment, and the loss of manufacturing contracts to other countries around the world. The country’s hidden debt, estimated to be between $7 trillion to $11 trillion, poses a significant risk to its financial stability, with the potential for a wave of defaults leading to a nationwide financial crisis. Additionally, the country’s growth targets for 2024 are expected to be lower than previous years, with the majority favouring around 5%, indicating a slowdown in the economy. However, given the attractive valuations and likelihood of government stimulus in the short term, we see select opportunities in the Chinese equity market. Specifically, we believe Consumer and Technology firms may benefit from the government’s forthcoming actions. The central government is aware that Chinese GDP must be more consumption-focused and it cannot afford to lag in a rapidly unfolding technological revolution.

China has room to manoeuvre when it comes to stimulating its economy via monetary and fiscal means. It has exercised some restraint on monetary and fiscal stimulus with respect to boosting GDP, since it wants to avoid another real estate bubble and improve the balance sheets of state-owned banks saddled with bad loans. If and when China chooses to go for broader economic stimulus, we may see a strong impetus for stock market growth in the country. China’s aims to reunify Taiwan, by almost any means necessary, remains a long-term risk, but we believe that scenario will not unfold in 2024, giving investors a window of opportunity to ride a stimulus wave. China’s economic growth might surprise on the upside as market expectations of growth remain subdued, especially if and when the PBOC loosens its monetary policy to stimulate growth.

It is worth mentioning that China is holding the keys not only to fossil fuel consumption as it buys more global natural resources than any other country, but also to the clean energy revolution as it controls many components of the alternative energy global supply chains including electric vehicles. We therefore deem the Chinese economy’s healthy 2024 performance as one of the key elements for global economic well-being and in the fight against inflation.

China has increasingly asserted its global leadership aspirations via the Belt and Road initiative as well as by taking a different view than the U.S. on some pivotal global issues. We expect the Taiwanese election in early 2024 to influence not only the Chinese investment climate but also the global US-China stand-off, which in turn has direct implications for Chinese economic and business developments. Specifically, we see the “friend shoring” and de-globalisation trends continuing. These secular trends should benefit Japan and the emerging markets of India, Vietnam, Indonesia, Saudi Arabia, and Mexico. We suggest exposure to these markets via ETFs as navigating local uncertainties is tricky due to imperfect market information flow. Emerging markets are generally trading at lower valuations than developed markets, and relative to the prior histories, providing attractive entry points for long-term investors. (See graph below).

The Attractiveness of Equity Valuations Outside the U.S.

Source: JP Morgan

Are Black Swans Likely to Win Over Grey Rhinos?

It has the feel this year more than most, that unknown unknowns for the year ahead are greater than in previous years. Climate phenomena and resulting disruption is a somewhat expected potential ‘black swan’. Known unknowns may include new wars (i.e. Venezuela and Guyana) or, more specifically, the unknown timing and exact outcome of the ongoing wars. On top of geopolitics, high interest rates and low growth in certain regions could lead to increased financial volatility, while disruptions in key shipping routes could impact global trade and commodity prices. Additionally, the ongoing transition towards a decarbonised economy could lead to regulatory changes and technological disruptions across various sectors.

As the frequency of ‘black swan’ events increases, companies and investors will seek to better manage their risks, leading to increased demand for risk management and insurance services. Companies offering business continuity and disaster recovery solutions may experience growth as businesses look for ways to ensure their operations can withstand unexpected disruptions. The escalation of unknown unknowns could lead to increased volatility in financial markets, affecting the stock prices of companies across various sectors. Investment firms may need to adjust their strategies as this increase in unknown unknowns could lead to a shift from conservative, long-term investments to high-risk, high-reward investments. Companies with high levels of debt or leverage may face increased financial risk due to the potential for unexpected economic shocks, which could lead to a decline in their stock prices. The escalation of unknown unknowns could lead to increased regulatory scrutiny, particularly for companies in sectors such as finance and technology, potentially impacting their stock prices.

There is always room, as we have seen especially over the last 5 years, for unknown unknowns to heavily influence investment outcomes. We prefer the ‘grey rhino’ (a foreseeable and manageable unknown unknown) to the ‘black swan’ (a totally unforecastable unknown unknown) approach to risk management, as history shows that there are early signs of many developments like the Global Financial Crisis of 2008 (except perhaps for the likes of COVID-19 and similar occurrences).

Conclusions

The current slowdown in global economic growth on the heels of a surprisingly robust 2023 through Q3 may result in increased market volatility once earnings season is underway in a few weeks. We believe once central banks begin to cut interest rates in earnest, between March and May depending on how the data reads, the markets may dip and then deliver a more sustainable rally with the Fed coming to the rescue and other central banks to follow. The large amounts of cash on the sidelines in concert with soon-to-be-vanishing high yields on investment-grade sovereigns and time deposits may ensure there is an ample supply of “buy on the dip” investors.

We think the main risk to our forecasts is geopolitical in nature namely, a worsening of U.S-China relations. Of course, if the aforementioned risk diminishes, there may be further upside to our forecasts. ‘Black swan’ or ‘grey rhino’ risks, or the totally unknown substantial risks or foreseeable ones, always lurk around the corner. For instance, the escalation of a military conflict in the Middle East may lead to inflationary pressures, which may prove acute in the light of doveish FED interest rate remarks. Nevertheless, smartly constructed diversified portfolios and regular monitoring with prudent risk management in mind leading to prompt rebalancing if needed, should be able to withstand the initial shock and live to fight another day on the rocky path to ever-increasing wealth.

Related

Quantum technologies: the next digital revolution

Kirill Pyshkin Investors fear the quantum concept as an unknown quantity, but once they analyse case studies around its transformative nature, it is likely to rival the potential of AI © Envato This article was published in PWM, and FT-affiliate publication, on 14 Nov. 2025 The year 2025 marks a century since quantum mechanics reshaped […]

Can Europe afford its rearmament?

WELREX Chief Investment Officer Kirill Pyshkin shares his latest thoughts

TRiUMPh of the Contrarians

WELREX CIO Kirill Pyshkin updates on our 2025 Investment Outlook 3 months on

Robots, relationships and revolutionary investments

WELREX CEO Yevgeni Agerd is interviewed by Yuri Bender and Ali Al Enazi as part of the FT/PWM “Tea Break” series. They discuss the future of wealth management and whether peace talks in Ukraine can spur a much-needed recovery for troubled European economies.

Could 2025 be a better year for thematic equities?

In this article, Kirill Pyshkin, Chief Investment Officer at WELREX, examines whether 2025 could be a better year for thematic funds.

US equities and the dollar deliver a ringing endorsement of Trump. What now?

WELREX Chief Investment Officer, Kirill Pyshkin, offers our investment outlook for 2025 with a non-consensus preference for European vs US assets, including equities, fixed income, and EUR/USD. We like Gold and CHF as a USD inflation hedge but are cautious about commodities.

“Rapid ascent for WELREX – thoughts on business models, Consumer Duty, and more”

Updated WELREX profile published by WealthBriefing following WELREX® Founder and CEO Yevgeni Agerd and Chief Marketing Officer Joe Clift interview with Tom Burroughes, Group Editor.

WELREX included in 2024 WealthTech100 listing

Sixth annual WealthTech100 list names WELREX in their list of companies transforming the world of wealth and asset management.

WELREX joins global elite with double win at WealthBriefing European Awards 2024

At the WealthBriefing European Awards on March 21st, leading wealth management industry participant, WELREX, was selected as a winner in the ‘Innovative Use of Artificial Intelligence’ and ‘Most Promising New Entrant’ categories.

Data, dashboards, and digital wealth

WELREX founder and CEO Yevgeni Agerd speaks to PWM’s editor-in-chief Yuri Bender about the increasing appetite of private investors in developing countries for a hybrid digital and human advice model

WELREX CIO, Kirill Pyshkin, invited to present at University of Cambridge

Last week, our Chief Investment Officer, Kirill Pyshkin, led a class of University of Cambridge Master of Finance students at Judge Business School, where he shared his extensive experience in developing and managing thematic investment strategies. Thematic investing, as Kirill explained, is all about identifying the powerful, long-term trends shaping our future and translating them […]

Strong 1H 2025 Performance of Our Thematic Investment Strategies

In a financial landscape constantly reshaped by powerful global forces, understanding and responding to long-term trends is paramount. At WELREX, we believe in a proactive approach to investment, rooted in deep thematic analysis and a multi-asset strategy designed to navigate complex markets. As we reflect on the first half of 2025, our Chief Investment Officer, […]

US Treasuries deserve another look

The recent escalation in the Israel-Iran conflict has sharpened investor focus on the relationship between oil prices and financial markets. While the typical ‘risk-off’ response—favouring bonds and pressuring equities—is well understood during periods of geopolitical tension, the implications of rising oil prices are more nuanced. Moreover, most economists speak in unison about their overwhelming belief that Trump’s […]

Future of thematics is multi-asset

When we published our 2025 investment outlook exactly 6 months ago, it looked highly contrarian. It was the market honeymoon after the US elections, the “Trump trade” was in full swing and there seem to have been no alternative to US equities and in particular, their “Magnificent 7” technology behemoths. Instead, we argued that the […]